Advertisement|Remove ads.

SpaceX Shoots For $800B Valuation To Overtake OpenAI — And Tells Investors A 2026 IPO Is On The Horizon: Report

- CFO Bret Johnsen has been updating investors on a secondary sale that would double SpaceX’s earlier $400 billion valuation, the WSJ reported.

- The company continues to scale Starlink, expand direct-to-cell capabilities, and advance its Starship program.

- SpaceX recently secured major U.S. government contracts, including a $5.9 billion Space Force deal and $2 billion in expected satellite funding.

SpaceX is reportedly launching a secondary share sale that assigns the rocket-maker an $800 billion valuation, a level that would lift it above OpenAI as the most valuable private company in the U.S.

Chief Financial Officer Bret Johnsen has been informing investors of a new secondary sale, which could double its valuation from the roughly $400 billion level from its earlier offering, according to a report by The Wall Street Journal.

Satellite Operations

SpaceX carries out missions for a wide range of users, from commercial satellite operators to government agencies. The company also continues development of Starship, the large rocket intended for missions that include a planned NASA astronaut landing on the moon.

Its infrastructure now includes a large constellation of Starlink satellites supporting its internet service. The network consists of about 9,000 satellites, and in November Starlink reported more than eight million active customers worldwide.

Alongside operating the satellite network, the company is expanding into services that link satellites directly to consumer mobile devices. To advance that effort, SpaceX reached agreements to obtain spectrum from EchoStar, with commitments exceeding $20 billion in cash, stock and debt. “We are so pleased to be doing this transaction with @EchoStar… to advance our mission to end mobile dead zones everywhere on Earth,” President Gwynne Shotwell said in a September post on X.

SpaceX Prepares For Potential 2026 IPO

At Tesla’s annual meeting last month, Elon Musk said he is working on a way for Tesla shareholders to own stock in SpaceX and added that the company “should” eventually become a public company, while noting that an IPO is not expected soon.

SpaceX has also told investors it is aiming for a late-2026 initial public offering, according to a report by The Information, citing two people familiar with the discussions.

SpaceX has recently expanded its work with U.S. government programs, including a $5.9 billion Space Force contract covering 28 missions through 2029. The company is also expected to receive $2 billion in federal funding to develop satellites for the Golden Dome project.

In the broader private-company landscape, OpenAI has reportedly considered a public debut with a potential valuation near $1 trillion.

Stocktwits Users Remain Cautious

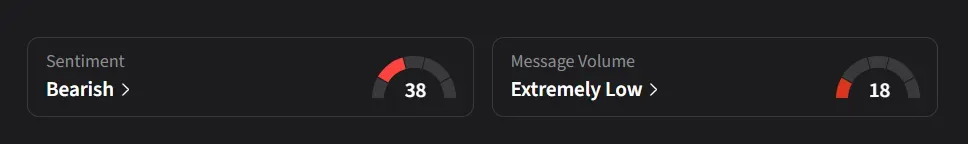

On Stocktwits, retail sentiment for SpaceX was ‘bearish’ amid ‘extremely low’ message volume.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)