Advertisement|Remove ads.

RBI’s Eased Norms Spark REC Rally: SEBI RA Navodit Tiwari Recommends Buy Above ₹420

In a move set to benefit infrastructure financiers, the Reserve Bank of India (RBI) has released its final guidelines on provisioning for project loans, easing the earlier proposed stringent norms.

SEBI-registered analyst Navodit Tiwari observed that this policy shift is particularly favorable for REC, a key state-run infrastructure finance company, primarily focused on power sector lending.

At the time of writing, REC shares had risen over 3% on Friday.

RBI Eases Infra Loan Norms

Under the earlier draft guidelines, the RBI had proposed a 5% Provisioning Coverage Ratio (PCR) during the construction phase of a project loan, 2.5% during the operational phase, and a reduction to 1% if certain financial milestones were achieved.

The final guidelines have eased these requirements considerably. Now, only a 1% PCR is mandated for general project loans during construction, and 1.25% for under-construction commercial real estate (CRE). In the operational phase, PCR requirements range from 0.4% to 1%, depending on the type of project.

Why Is This Positive For REC?

Tiwari noted that with the eased norms, REC can now allocate more funds to growth and new projects. It will also see improvement in earnings visibility, as well as the balance sheet, as less capital needs to be reserved for risk buffers.

On the technical charts, Tiwari highlighted that the stock has formed a symmetrical triangle bounded by converging trendlines over the last several weeks.

REC is currently trading near the lower trendline support zone of ₹360–₹380, marked by multiple bounces, which indicates strong demand. However, the stock has been unable to close above ₹420 on a weekly closing basis.

Tiwari recommends entering above ₹420 (provided there is a weekly close), with the first target at ₹470-₹480, followed by a target above ₹550. He advises keeping the stop loss below ₹350 on a weekly closing basis.

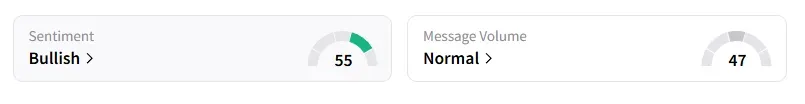

Data on Stocktwits shows retail sentiment is ‘bullish’ on the counter.

REC shares have fallen 21% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)