Advertisement|Remove ads.

RBI’s M&A lending push won’t shake up private credit just yet, says GreenEdges' Digant Hari

Digant Haria, Founder of GreenEdge Wealth Services, suggests that experienced players like JM Financial could benefit from the new framework, as it opens up opportunities for them to partner with banks for funding instead of relying solely on private equity firms, sovereign funds, or institutional investors.

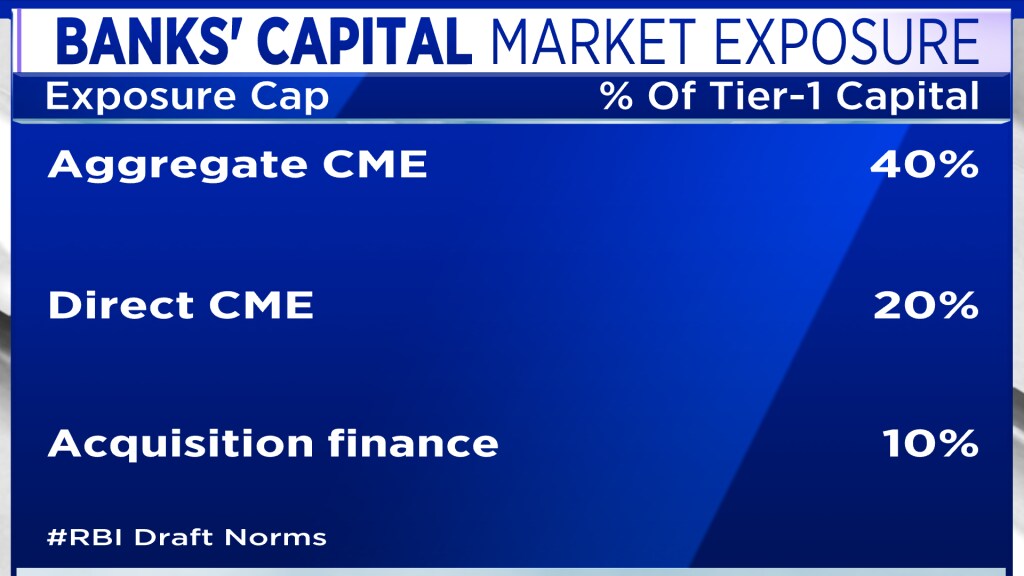

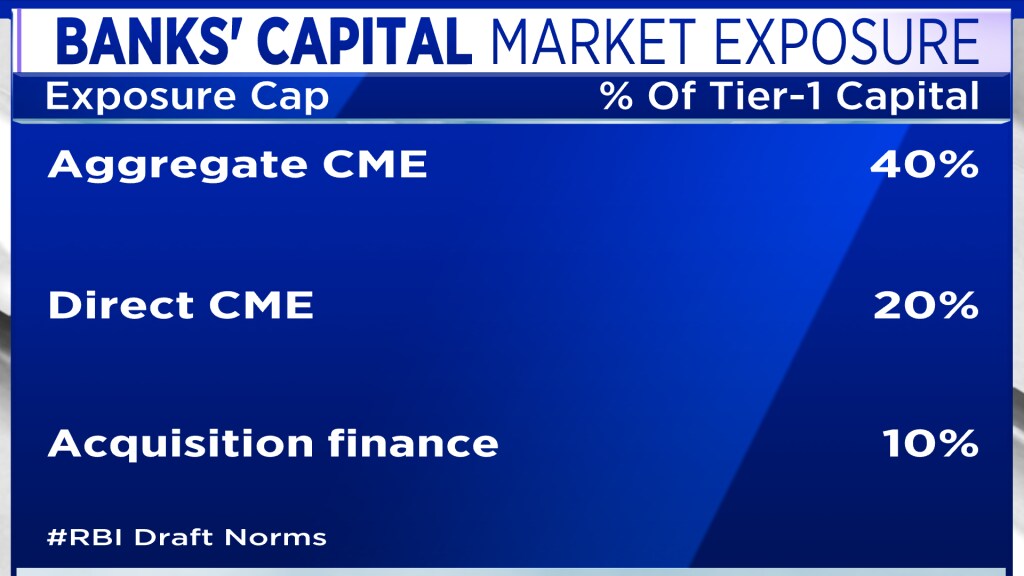

Digant Haria, Founder, GreenEdge Wealth Services, believes the Reserve Bank of India's (RBI's) new draft guidelines on acquisition financing is a good start and an acknowledgement of the growing importance of mergers and acquisitions (M&A) for corporate growth. However, he expects banks to be slow in embracing this new lending avenue, which will allow the existing structured finance and private credit markets to continue thriving.

Haria provided historical context, stating that for the past 20-25 years, the RBI has been very cautious, or "allergic," to allowing banks to finance two specific sectors: real estate and capital market-linked activities like lending for shares or mergers and acquisitions (M&A). "What we are seeing now is a good start and, in a way, it is also an acknowledgement by RBI that a lot of growth in the future is going to come via the acquisition route," he said. He believes that with a slowdown in many large sectors, acquisitions will be a key driver of growth over the next five to ten years.

Despite the positive intent, Haria does not expect an immediate surge in acquisition financing from banks. He stated that for the last decade, such deals have been predominantly handled through the "structured financing" route by non-banking financial companies (NBFCs) and specialised firms like JM Financial and the erstwhile Edelweiss and Yes Bank. While some of these deals might now shift to the banking domain, he believes many will remain with the specialised structured finance players.

The primary reason for this, according to Haria, is the lack of expertise and risk appetite within the banking sector. "The banking sector over the last eight-ten years, they completely shied away from this kind of financing," he explained, alluding to the asset quality issues of the past. "Banks will take time to build those expertise to understand the product, take some risks. So, I think it's a slow journey for banks."

Also Read: Banks lead renewed investor interest in Indian financials

He further stated that most private sector banks are not even particularly aggressive on standard corporate lending, let alone more complex M&A financing, which he considers a later-stage product. Consequently, he does not foresee the new rules pushing credit growth immediately for any of the banks.

This cautious approach from banks means that the private credit market and specialised NBFCs will not face a significant threat to their market share.

Also Read: IOB CEO says asset quality improving, margins protected despite rate cuts

On the contrary, Haria suggests that players like JM Financial, with their long-standing experience, could even benefit. "Now they can even partner with banks for their funding. They don't just need to partner with the private equities or the sovereigns or the institutions," he said. The RBI's framework, in his view, may open up new funding avenues for these specialised lenders rather than creating direct competition.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Haria provided historical context, stating that for the past 20-25 years, the RBI has been very cautious, or "allergic," to allowing banks to finance two specific sectors: real estate and capital market-linked activities like lending for shares or mergers and acquisitions (M&A). "What we are seeing now is a good start and, in a way, it is also an acknowledgement by RBI that a lot of growth in the future is going to come via the acquisition route," he said. He believes that with a slowdown in many large sectors, acquisitions will be a key driver of growth over the next five to ten years.

Despite the positive intent, Haria does not expect an immediate surge in acquisition financing from banks. He stated that for the last decade, such deals have been predominantly handled through the "structured financing" route by non-banking financial companies (NBFCs) and specialised firms like JM Financial and the erstwhile Edelweiss and Yes Bank. While some of these deals might now shift to the banking domain, he believes many will remain with the specialised structured finance players.

The primary reason for this, according to Haria, is the lack of expertise and risk appetite within the banking sector. "The banking sector over the last eight-ten years, they completely shied away from this kind of financing," he explained, alluding to the asset quality issues of the past. "Banks will take time to build those expertise to understand the product, take some risks. So, I think it's a slow journey for banks."

Also Read: Banks lead renewed investor interest in Indian financials

He further stated that most private sector banks are not even particularly aggressive on standard corporate lending, let alone more complex M&A financing, which he considers a later-stage product. Consequently, he does not foresee the new rules pushing credit growth immediately for any of the banks.

This cautious approach from banks means that the private credit market and specialised NBFCs will not face a significant threat to their market share.

Also Read: IOB CEO says asset quality improving, margins protected despite rate cuts

On the contrary, Haria suggests that players like JM Financial, with their long-standing experience, could even benefit. "Now they can even partner with banks for their funding. They don't just need to partner with the private equities or the sovereigns or the institutions," he said. The RBI's framework, in his view, may open up new funding avenues for these specialised lenders rather than creating direct competition.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/stylam-ind-2025-10-52e2a72e1e2b9949dd3b7bdafdf8786c.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/c251027b-002h-2025-10-90f31ac3b96d43b1def99d090d50a8cf.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Gold_resized_new_jpg_fee097f3fc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/20250320041134_sensex_nifty-marketup_sensexup-Niftyup.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/shutterstock-2424556985-2025-09-e89f97dba6857c9a3b3c77872f30d4cf-scaled.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2018/03/shutterstock_574323772.jpg)