Advertisement|Remove ads.

RealReal Stock Rises On Q4 Revenue, GMV Performance: Retail Stays Extremely Bullish

Shares of the RealReal Inc. (REAL) rose 1.9% in after-hours trading Friday after the online marketplace for luxury goods posted a bump in its gross merchandise value and revenue for its fourth quarter, with retail staying optimistic.

The company’s Q4 gross merchandise value (GMV) and total revenue increased 12% and 14%, respectively, compared to the year-ago period. Its full year 2024 GMV and total revenue increased 6% and 9% in the same period.

For the latest quarter, loss per share stood at $0.01, narrower than the $0.04 expected by Wall Street analysts. While its revenue of $163.99 million beat estimates of $163.73 million.

For its 2025 fiscal, it projected GMV between $1.96 and $1.99 billion. Revenue is projected between $645 and $660 million, compared to the consensus estimate of $655.98.

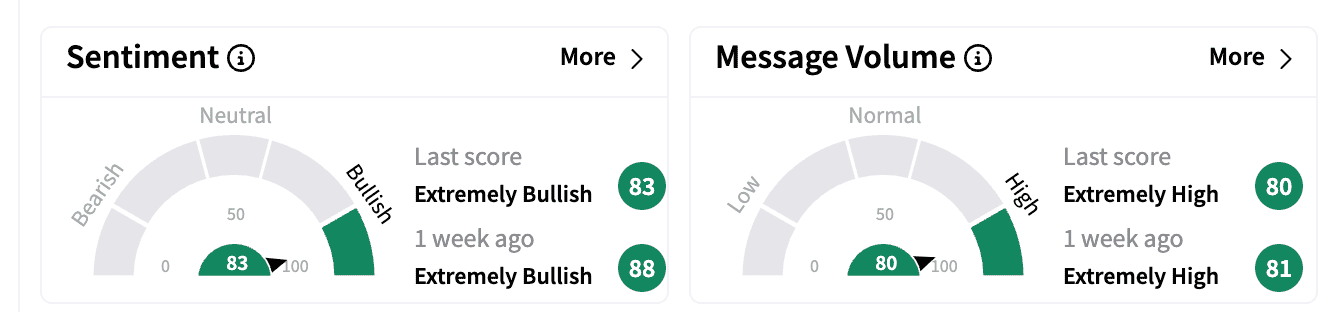

Sentiment on Stocktwits remained in the ‘extremely bullish’ territory compared to a week ago. Message volume continued to be in the ‘extremely high’ zone.

One commenter termed the stock as a “long-term” buy-and-hold.

“We achieved strong fourth quarter and full year 2024 results, exiting the year from a position of strength," said Rati Levesque, President and CEO of The RealReal. “We delivered on key milestones in 2024 including positive Adjusted EBITDA and positive free cash flow for the full year, and we are just getting started.”

Levesque added the company is continuing its progress on strategic pillars, unlocking supply, and making efforts to drive operational efficiency. The company also sees significant opportunity to drive operating leverage and improve the consignor experience through enhanced use of AI.

CFO Ajay Gopal added that the company’s recent strategic debt transaction has reduced its overall indebtedness.

Following the earnings, Baird analyst Mark Altschwager raised the price target to $8.50 from $8 with a ‘Neutral’ rating, noting its Q4 results were in line and profitability is getting real, The Fly reported.

RealReal stock is down 41% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_da95861470.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233716109_jpg_230d917a7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)