Advertisement|Remove ads.

Realty Income Stock Falls Aftermarket On Tepid 2025 Forecast, Retail’s Unfazed

Realty Income Corp (O) stock was down 1.5% in extended trade after the company forecast 2025 adjusted funds from operations (FFO) below Wall Street’s estimates.

The company forecast 2025 adjusted FFO, a metric that gauges the profitability of real estate firms, between $4.22 and $4.28 per share, while analysts, on average, expect the company to post $4.31 per share.

Its net income fell to $199.6 million, or $0.23 per share, for the three months ended Dec. 31, compared with $218.4 million, or $0.30 per share, in the year-ago quarter.

Realty Income posted fourth-quarter adjusted FFO of $1.05 which was in line with Wall Street’s estimates.

The company owns or holds interests in 15,621 properties, and its clients include Walmart, The Home Depot, and AMC Theatres.

As of Dec. 31, the company’s portfolio occupancy was 98.7%, with 205 properties available for lease or sale, as compared to 98.7% occupancy on Sept. 30.

The company said it achieved a rent recapture rate of 107.4% on properties re-leased during the reported quarter.

Its same-store rental revenue increased to $992.8 million during the fourth quarter from $985.2 million, last year.

During the fourth quarter, the company acquired 233 real estate properties after investing $1.32 billion.

The company had closed its $9.3 billion deal for peer Spirit Realty Capital last year.

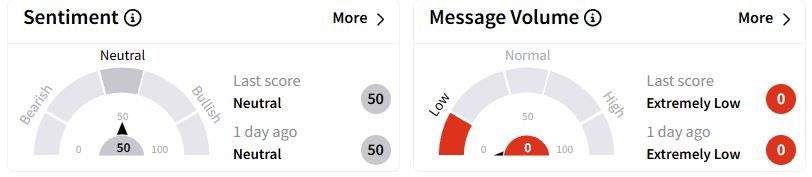

Retail sentiment on Stocktwits remained in the ‘neutral’ (50/100) while retail chatter was ‘extremely low.'

Over the past year, Realty Income stock has gained 8.1%.

Also See: Public Storage Slips In Extended Trade As Core FFO Misses Estimates, Retail’s Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)