Advertisement|Remove ads.

Public Storage Slips In Extended Trade As Core FFO Misses Estimates, Retail’s Bearish

Public Storage (PSA) stock fell 0.9% in extended trade on Monday after the company’s core funds from operations (FFO) fell short of Wall Street’s estimates.

The company said its core FFO, a metric used to gauge the profitability of REITs, was $4.21 per share, while analysts, on average, expected it to post $4.24 per share, according to FinChat data.

Public Storage reported fourth-quarter revenue of $1.18 billion, roughly in line with Wall Street estimates.

The company posted a net income of $564.4 million, or $3.21 per share, for the quarter ended Dec. 31, compared with $389.7 million, or $2.21 per share, in the year-ago quarter. The REIT attributed the rise to an increase in foreign currency gains.

The company’s square foot occupancy in same-store facilities declined to 91.8% during the fourth quarter from 92.4% last year.

Its average annual contract rent per square foot declined 5% to $13.04 for customers moving in.

During the quarter, it acquired 17 self-storage facilities with 1.3 million net rentable square feet for $221.2 million.

The company forecast 2025 core FFO to be in the range of $16.35 and $17 per share. On the other hand, analysts expect it to post $16.9 per share.

Public Storage expects the pricing restrictions associated with the California wildfires last month to impact Core FFO by $0.23 per share in 2025.

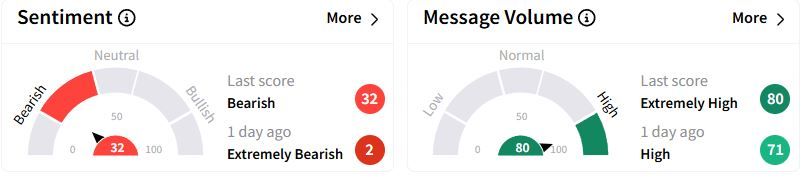

Retail sentiment on Stocktwits moved to the ‘bearish’ (32/100) territory from ‘extremely bearish’(2/100) a day ago, while retail chatter rose to ‘extremely high.’

Over the past year, Public Storage stock has gained 6.8%.

Also See: ONEOK Stock Gains After The Bell Following Q4 Profit Rise: Retail Mood Brightens

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2261646866_jpg_de6ca7bdf0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/iran_fm_iaea_chief_rafael_mariano_grossi_jpg_79ef4dc11f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qualcomm_CEO_OG_jpg_7352181faa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)