Advertisement|Remove ads.

Reddit Momentum Draws Retail Buzz: Stock Rallies 10% In 3 Days To Test Lifetime High

- Reddit generates buzz on Stocktwits amid a sharp stock rally.

- Shares rise by over 10% in three consecutive sessions of gains.

- The majority of analysts recommend buying the stock, expecting the company to benefit from its AI ad tools and the prominence of Reddit content in AI-generated answers in chatbots.

Retail interest in Reddit Inc. picked up sharply on Tuesday as the stock rallied, with some Stocktwits users saying they were adding to their positions.

Stock Rallies As Year Opens

Shares of the online forum site surged by 10.5% in the last three trading sessions to $253.81, advancing closer to their record high of $270.71 from September last year. RDDT rose by over 40% in 2025, while peers Snap and Pinterest saw their stocks decline.

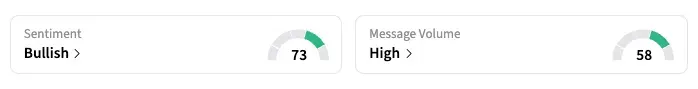

On Stocktwits, the retail sentiment for the ticker moved multiple points higher in the ‘bullish’ zone, with ‘high’ message volume, on Tuesday. Chatter around the stock has surged by more than 35% over the past seven days.

AI Beneficiary

The renewed interest comes as Reddit is increasingly seen as a key beneficiary of the artificial intelligence boom. The company rolled out a range of AI-powered tools for advertisers last year that helped lift revenue, while partnerships with AI players such as OpenAI are pushing Reddit content into chatbots and driving additional traffic to the site.

Needham named RDDT among its top picks for 2026, stating that the company is already generating over $100 million per year in fees from OpenAI and Google's Gemini, and this "could double" with Anthropic and Perplexity fees.

Reddit is "disproportionately cited" in AI-generated answers. As AI-answers replace links, economic benefits shift to the citations that AI-answers give, and 20%-40% of citations are to Reddit, the investment research firm said in a recent client note.

Analysts Bullish

“I'm convinced this is the next great social media company,” said a Stocktwits user.

Currently, 17 of the 28 analysts covering Reddit have a ‘Buy’ or higher rating on its stock, 10 rate it ‘Hold,’ and one rates it ‘Sell,’ according to Koyfin data. Their average price target of $246.32, however, is lower than the stock’s last closing price.

Reddit is expected to announce its fourth-quarter results next month.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)