Advertisement|Remove ads.

‘Mind-Blowing Beat’: Reddit’s Q2 Surge Ignites Wall Street And Retail Optimism Alike

Reddit Inc. (RDDT) has received positive updates from several analysts, each raising their price targets on the social media company and highlighting strong momentum in ad revenue and user engagement, after better-than-expected Q2 earnings.

Truist lifted its price target to $225 from $160 while maintaining a ‘Buy’ rating, noting Reddit’s robust Q2 earnings beat and Q3 guidance that significantly outpace consensus, as per TheFly.

The firm said the earnings beat was anchored by rising advertiser spending and solid product-market alignment.

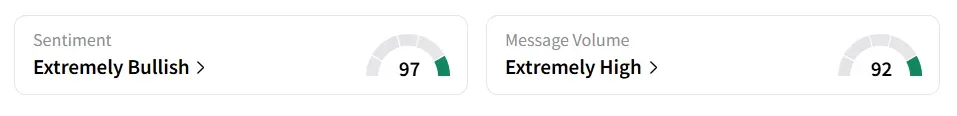

Reddit stock traded over 20% higher on Friday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ (97/100) territory, with the message volume shifting to ‘extremely high’ (92/100) from ‘high’ levels.

The stock saw a 391% jump in user message count in 24 hours. A bullish Stocktwits user said the company’s fundamentals are strong.

Roth Capital raised its price target to $185 from $145, though retaining a ‘Neutral’ stance. The firm described Reddit’s Q2 results as a “mind‑blowing beat and raise.” It believes the company’s monetization gains will support growth into late 2025, with further upside if Reddit can streamline account signup, even as it cautions against buying the rally.

Raymond James increased its target to $225 from $175 and reaffirmed a ‘Strong Buy’ rating. The firm highlighted Reddit’s 19% revenue beat, attributing the success to rising advertiser demand and improvements in Reddit’s ad platform.

The company’s revenue climbed 78% year over year (YoY) to $500 million, beating the analysts’ consensus estimate of $425.97 million, as per Fiscal AI data.

Earnings per share (EPS) of $0.45 also exceeded the consensus estimate of $0.19.

Reddit stock has gained over 16% in 2025 and over 220% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)