Advertisement|Remove ads.

Reddit Stock Gets Sell Recommendation As Analyst Expresses Concerns Over Lofty Valuation: Retail’s Cautious

Reddit, Inc.'s (RDDT) stock fell in Monday’s pre-market session after the community-focused social media company received a sell recommendation from research firm Redburn Atlantic.

Redburn Atlantic initiated coverage of the San Francisco, California-based company with a ‘Sell’ rating and a $75 price target, TheFly reported. The firm’s price target implies a nearly 42% potential downside from current levels.

Redburn Atlantic noted that Reddit stock traded at a 22 times multiple of the fiscal year 2027 enterprise value to earnings before interest, taxes, depreciation, and amortization (EBITDA) estimates. If stock-based compensation expenses are stripped off, the valuation multiple is a loftier 54 times.

Redburn Atlantic analysts noted that typically fast-growing internet platforms command high multiples due to the size of the online advertising market and the business model’s inherent operating leverage.

However, they said Reddit’s significant premium versus that of social e-commerce company Pinterest, Inc. (PINS) would be viewed as “far too lofty,” especially as Reddit’s growth rates start to stabilize.

The brokerage said Reddit stock poses a significant downside risk due to the potential multiple compression and downward re-rating of estimates.

Last week, Raymond James reduced the stock price target to $200 from $250 but maintained a ‘Strong Buy’ raring. The firm backed the action on the higher risk of a soft macroeconomic environment.

However, the firm said it would be a stock buyer of the recent weakness. It sees a long-term path to $50 average revenue per user (ARPU) for Reddit. In the fourth quarter that ended in December, the metric came in at $4.21, representing a 23% year-over-year increase.

Raymond James estimates that improving on-platform search could add up to $100 million in revenue next year.

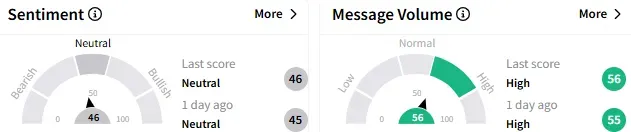

On Stocktwits, retail sentiment toward Reddit’s stock remained ‘neutral’ (46/100), while message volume stayed ‘high.’

A bullish watcher noted an increasing number of video ads on the Reddit platform and said these ads suggest vigorous monetization activity.

https://stocktwits.com/Poopoo/message/608243210

Other users mirrored analysts’ valuation concerns, with some even suggesting a stock move below $80.

https://stocktwits.com/CaptainofRobots/message/608138486

Reddit stock traded down 0.89% at $127.07 in the pre-market session. It is down about 22% year-to-date, although it has gained over 154% since listing in March last year. The stock has traded in a 52-week range of $37.35 to $230.41.

The Koyfin-compiled consensus price target for Reddit stock is $202.11, suggesting nearly 58% upside potential.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: DocuSign, Adobe, Rubrik And More: 5 Tech Stocks That Saw Brisk Retail Activity Last Week

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246131051_jpg_78a656bc06.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_gravity_jpg_173d7fb4ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)