Advertisement|Remove ads.

DocuSign, Adobe, Rubrik And More: 5 Tech Stocks That Saw Brisk Retail Activity Last Week

Tech stocks led last week’s sell-off amid rising uncertainty around the macroeconomic and geopolitical fronts. Against the backdrop, the following stocks saw brisk retail activity on their streams in the past week:

DocuSign, Inc (DOCU) - 4,900% increase in message volume

San Francisco, California-based DocuSign saw its shares surge by nearly 7.5% in the week ended April 14, thanks to its estimate-beating results for the fourth quarter of the fiscal year 2025.

The cloud platform company that allows individuals and businesses to sign and share documents electronically also issued an upbeat forecast for the fiscal year 2026.

Following the quarterly beat, analysts were largely positive about the company.

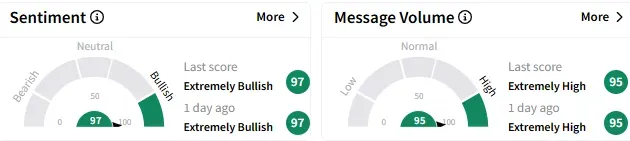

On Stocktwits, retail sentiment toward DocuSign stock remained ‘extremely bullish’ (97/100), with the buoyant mood accompanied by ‘extremely high’ message volume.

Rubrik, Inc. (RBRK) - 1,200% increase in message volume

Palo Alto, California-based Rubrik, which provides data security solutions to individuals and businesses worldwide, reported better-than-expected results and strong operational metrics for the fourth quarter of the fiscal year 2025. The company’s first quarter and fiscal year 2026 guidance also exceeded expectations.

Reacting to the results, the stock jumped nearly 28% on Friday.

Analysts lifted their price targets for Rubrik stock following the fourth-quarter print, TheFly reported.

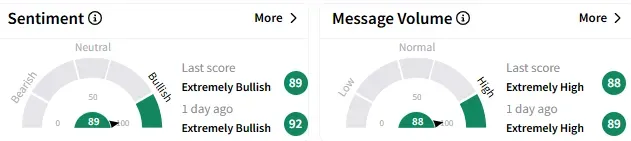

Retail sentiment toward Rubrik stock remained ‘extremely bullish’ (89/100), with the message volume staying at ‘extremely high’ levels.

Adobe, Inc. (ADBE) - 1,156% increase in message volume

Adobe stock sank nearly 14% on Thursday as investors ignored the quarterly beat and expressed concerns over the lackluster guidance and analysts’ tempering expectations concerning the company.

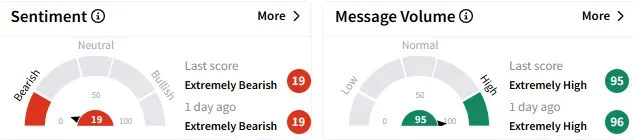

Retail sentiment toward the stock remained downbeat at ‘extremely bearish’ levels (19/100) and trader chatter remained at ‘extremely high’ levels.

Urgent.ly, Inc. (ULY) - 1,100% increase in message volume

Vienna, Virginia-based Urgent.ly’s shares slumped over 40% on Thursday, setting off a flurry of retail chatter. The plunge came after the nano-cap announced a one-for-12 reverse stock split that will take effect after the close of trading on Mar. 17, in a bid to regain Nasdaq compliance.

Urgent.ly provides a mobility assistance software platform for roadside assistance.

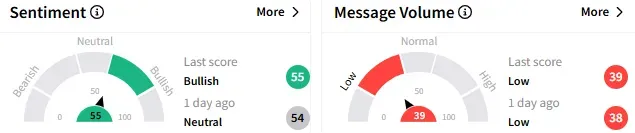

On Stocktwits, retail sentiment toward the Urgent.ly stock turned ‘bullish’ (55/100) from the ‘neutral’ mood seen a day earlier, as traders looked ahead to the reverse split. The message volume stayed at ‘low’ levels.

Lytus Technologies Holdings PTV. Ltd. (LYT) - 1,050% increase in message volume

Mumbai, India-based Lytus Tech stock fell over 20% on Friday. The company operates as a platform services company in India, distributing linear content streaming/telecasting services and developing telemedicine and fintech products.

Friday’s slump in Lytus Tech stock came despite the broader market strength and the absence of any major company-specific catalysts. Retail deliberated about the move, with some seeing a “pump-and-dump,” while others flagged the potential hand of short sellers.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Top 4 Communication Services Stocks That Caught Retail Investors’ Attention Last Week

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)