Advertisement|Remove ads.

Redfin Stock Surges 75% Pre-Market After Rocket Companies Agrees To Acquire Company In $1.75B Deal: Retail Cheers The Deal

Shares of digital real estate brokerage Redfin Corp (RDFN) soared over 75% in Monday’s pre-market session after fintech platform Rocket Companies (RKT) announced it would acquire the former in a $1.75 billion all-stock transaction at a value of $12.50 per Redfin share.

This would be Redfin’s best-ever single-day trading session if pre-market gains stay.

Each Redfin common stock will be exchanged for a fixed ratio of 0.7926 shares of Rocket Companies Class A common stock.

This represents a premium of 63% over the volume-weighted average price (VWAP) of Redfin's common stock for the 30 days ending March 7, 2025. Redfin shares closed Friday’s session at $5.82.

Following the announcement, shares of Rocket Companies fell over 15% in Monday’s pre-market session.

Rocket Companies said it will benefit from Redfin's nearly 50 million monthly visitors, one million active purchase and rental listings, and staff of over 2,200 real estate agents across 42 states.

The deal is expected to generate significant revenue benefits across search, real estate brokerage, mortgage origination, title, and servicing.

Rocket Companies anticipates the combined company will achieve more than $200 million in run-rate synergies by 2027. This includes approximately $140 million in cost synergies from rationalizing duplicative operations and other costs.

The firm also expects more than $60 million in revenue benefits from pairing the company's financing clients with Redfin real estate agents and driving clients working with Redfin agents to Rocket's mortgage, title, and servicing offerings.

Once the deal is closed, Redfin CEO Glenn Kelman will continue leading the business, reporting to Rocket Companies' CEO Varun Krishna.

"Rocket and Redfin have a unified vision of a better way to buy and sell homes," said Krishna. "Together, we will improve the experience by connecting traditionally disparate steps of the search and financing process with leading technology that removes friction, reduces costs, and increases value to American homebuyers.”

Rocket Companies will also simplify its organizational and capital structure. It will collapse its current "Up-C" structure, eliminate the high-vote/low-vote structure, and reduce its classes of common stock from four to two.

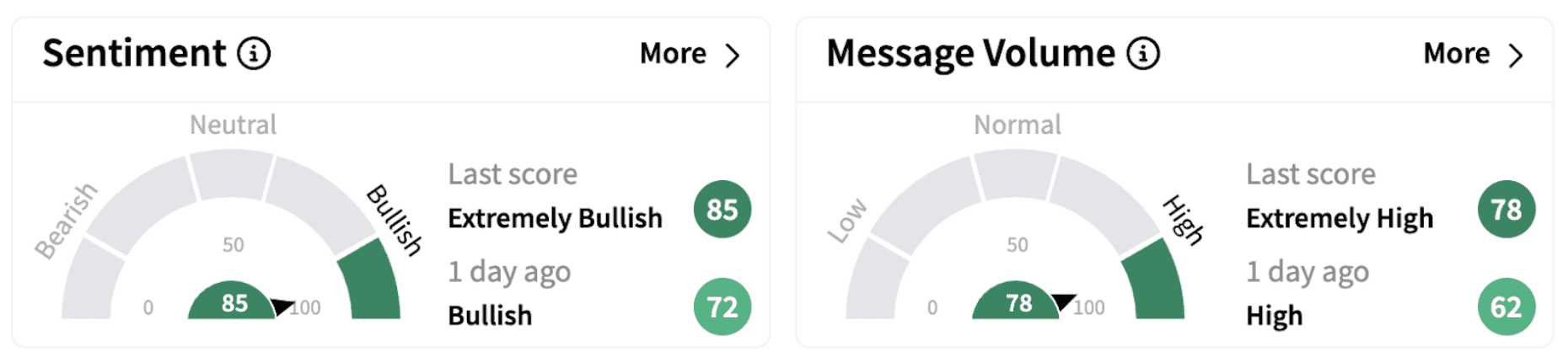

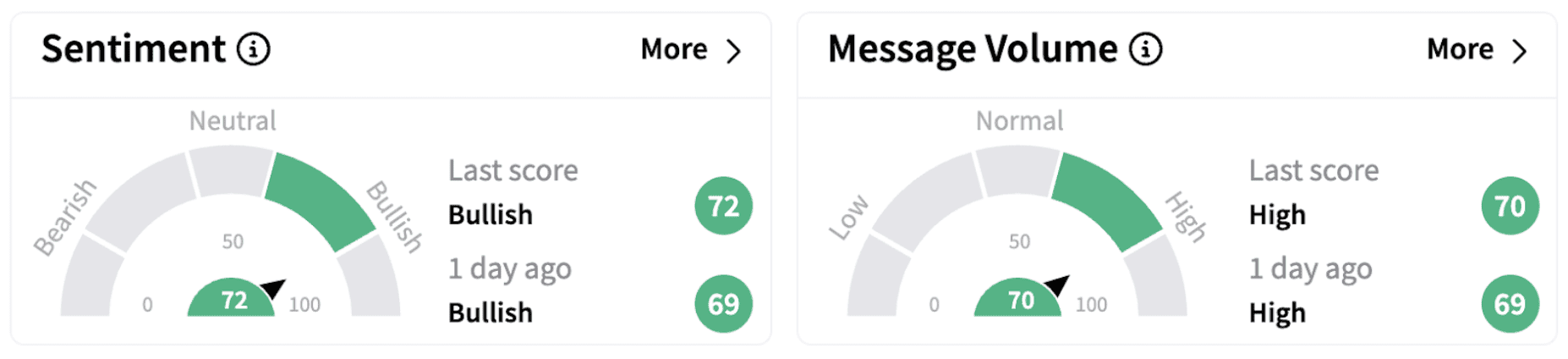

Following the announcement, retail sentiment on Stocktwits surrounding Redfin shares jumped into the ‘extremely bullish’ territory (85/100) from ‘bullish’ a day ago.

One user argued that any price under $12.5 for RDFN shares is attractive.

Shares of Rocket Companies have gained over 45% in 2025, while Redfin shares have lost over 25% in the period before factoring in Monday’s pre-market movement.

Also See: Veren, Whitecap Resources To Merge In $10.4B All-Stock Transaction: Retail Optimism Climbs

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Express_resized_d6044f410d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_axsome_resized_jpg_09f7c99fb1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238223992_jpg_be616a7919.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229019912_jpg_3e9bff3d29.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)