Advertisement|Remove ads.

Burger King Operator Restaurant Brands Asia Eyes Trend Reversal: SEBI RA Orchid Research Sees Over 30% Upside

Restaurant Brands Asia, which operates Burger King in India, has shown signs of recovery in the past few months, noted SEBI-registered analyst Orchid Research.

Although the stock has generally been in a downtrend since its December 2020 listing, it attempted to break above its 200-day exponential moving average (EMA) on Thursday, suggesting a possible shift in long-term momentum, the analyst added.

Restaurant Brands Asia stock has declined nearly 30% since its listing, but has seen a rebound of over 28% in the past three months.

A breakout over the ₹85-87 resistance zone could see the stock surge to ₹110 in the next few months, the analyst said while cautioning a stoploss below ₹73 on a closing basis.

The company's net loss narrowed in Q4 FY25, while revenue climbed 6% due to the addition of 58 Burger King outlets.

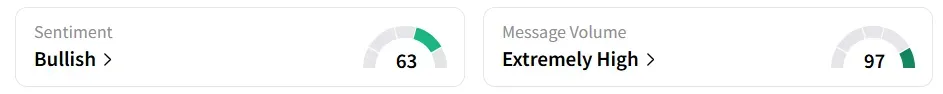

Retail sentiment on Stocktwits was ‘bullish’ amid ‘extremely high’ message volumes.

At the time of writing, the stock was up 1.2% at ₹79.5. Year-to-date (YTD), its shares have gained 6.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)