Advertisement|Remove ads.

Retail Chatter On BMY Doubles In 24 Hours With Drug Failing To Meet Primary Goal: Here's What Investors Are Thinking

Bristol Myers Squibb (BMY) announced on Friday that its drug, evaluated for myelofibrosis-associated anemia, did not meet its primary goal of achieving a state where patients no longer require transfusions to maintain adequate hemoglobin levels in a late-stage study.

Myelofibrosis is a rare type of blood cancer, with an annual incidence of approximately 0.3 cases per 100,000 individuals in the U.S. It is characterized by the buildup of scar tissue, called fibrosis, in the bone marrow.

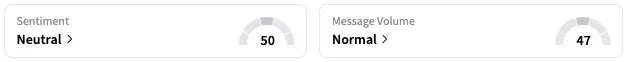

On Stocktwits, retail sentiment around BMY trended in the ‘neutral’ territory at the time of writing, coupled with ‘normal’ message volume.

A Stocktwits user opined that healthcare sector stocks, including BMY, are extremely oversold.

Another user responded, urging people to buy amid the fear.

The company was evaluating its drug Reblozyl with concomitant Janus Kinase Inhibitor (JAKi) therapy in adult patients with myelofibrosis-associated anemia receiving red blood cell (RBC) transfusions.

However, the study did not meet its primary goal of achieving a state where patients no longer require transfusions to maintain adequate haemoglobin levels during any consecutive 12-week period, starting within the first 24 weeks of treatment.

Bristol-Myers added that it will engage with the U.S. Food and Drug Administration and European Medicines Agency to discuss the submission of marketing applications.

Reblozyl is being developed and commercialized by Bristol Myers through a global collaboration with Merck (MRK) as of November 2021. The medicine is already approved in the U.S. for the treatment of anemia under certain conditions. However, it is not indicated as a substitute for RBC transfusions in patients who require immediate correction of anemia.

According to Stocktwits data, message count around BMY jumped 100% over the past 24 hours.

BMY stock is down 16% this year but up over 12% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)