Advertisement|Remove ads.

Autoliv Draws Retail Cheer As CEO Says Company Recovered Significant Portion Of Tariff Costs From Customers In Q2

Autoliv (ALV) CEO Mikael Bratt stated on Friday that the company has already recovered a significant portion of the tariff costs from customers in the second quarter and hopes to recover the remaining later this year.

“We remain confident that we can continue to successfully receive compensation from our customers for tariffs, although the industry outlook for tariffs is uncertain. We recovered around 80% of tariff costs in the second quarter, and we expect to recover most of what remains later in the year,” said CEO Mikael Bratt.

The company stated that U.S. tariffs had an estimated 35 basis points (bps) negative impact on its operating margin in the second quarter (Q2).

Autoliv also increased its full-year guidance for organic sales growth to around 3% from its previous expectation of about 2%, due to tariff compensation. It also reiterated its adjusted operating margin of around 10% to 10.5%.

The company’s second-quarter earnings exceeded Wall Street expectations, despite uncertainties related to tariffs. The supplier of automotive safety systems, such as airbags and seatbelts, reported net sales of $2.71 billion, up 4.2% year-over-year and above an analyst estimate of $2.64 billion, according to data from Fiscal AI.

While the company’s sales were negatively impacted by reduced light vehicle production in certain regions, such as the Americas and Europe, tariff compensations contributed to growth, the company said.

Adjusted and diluted earnings came in at $2.21, compared to $1.87 in the corresponding period of last year, and above an analyst estimate of $2.09.

The firm attributed the rise in profits to organic sales growth and successful execution of cost reductions, including measures such as a 5% reduction in total headcount. The company had only 65,100 headcount as of the end of Q2, compared to 68,700 employees at the end of the corresponding quarter in 2024.

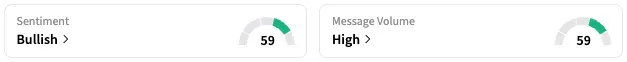

On Stocktwits, retail sentiment around ALV is currently trending in the ‘bullish’ territory, coupled with ‘high’ message volume.

According to data from Koyfin, none of the 19 analysts covering Autoliv have a ‘Sell’ rating on the stock. While 14 have a ‘strong buy’ rating on the shares of the company, five keep a ‘Hold rating with an average price target of $122.80, marking an upside of over 5%.

ALV stock is up 25% this year and approximately 8% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)