Advertisement|Remove ads.

Why American Express Drew Positive Retail Sentiment After Earnings Announcement

Retail sentiment for American Express brightened on Friday after the firm raised its full year earnings guidance while reporting a mixed set of earnings. The credit card giant raised its full-year earnings per share (EPS) guidance to $13.30 - $13.80 from $12.65 - $13.15 previously.

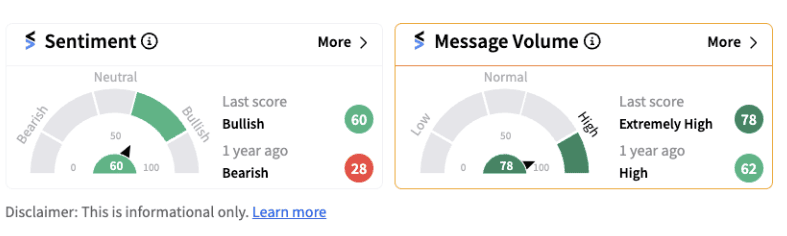

American Express also stated that it continues to expect revenue growth in line with the guidance range of 9%to 11% set at the beginning of the year. Retail sentiment on the stock is currently trending in bullish territory (60/100) supported by an extremely high message volume.

For the second quarter, the firm reported a 9% rise in its total revenues net of interest expense (forex adjusted) at $16.33 billion, which came in lower than a Street estimate of $16.59 billion. American Express said the rise in revenues was primarily driven by higher net interest income, increased card member spending, and continued strong card fee growth.

Network volumes increased 3% YoY to $440.60 billion during the quarter. The average fee per card increased to $101 compared to $91 in the same period last year. Active spending by the firm’s premium customers at a time when recession fears are fading has helped the firm keep up the earnings.

Stephen J. Squeri, Chairman and Chief Executive Officer at American Express said that an increased scale, combined with premium, high credit quality customers, well-controlled expense base and successful investments to continuously enhance the firm’s membership model, fuels the earnings power of the core business. This has reinforced the company’s confidence in its ability to deliver strong bottom-line growth, he said.

Earnings per share rose 21% year-over-year (YoY) to $3.49, higher than a Street estimate of $3.24. Net income rose 39% YoY to $3.02 billion.

Amidst all the upbeat numbers, the only blip was an increase in the consolidated provisions for credit losses that came in at $1.30 billion, compared with $1.20 billion a year ago. The increase reflected higher net write-offs, partially offset by a lower reserve build YoY, the firm said.

Squeri added that based on the strong performance of its core business, the firm believes it can increase its marketing investments by around 15% YoY without using any of the transaction gain, allowing it to drive the “profitable growth” that investors love to see.

American Express shares were trading nearly 2% lower in Friday’s pre-market session. The stock has performed well this year, having returned over 32% on a year-to-date basis. Based on current retail sentiment, it’s likely that at least some investors are looking to use this weakness to add to their longer-term positions.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iova_stock_jpg_ac0924fcdd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228840051_jpg_b05caad6aa.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)