Advertisement|Remove ads.

Analysts Believe SunPower Corporation Stock Could Go To Zero: Retail Investors Don’t Doubt It

SunPower Corporation shares plunged nearly 48% on Friday after a report, which cited dealers, indicated the firm will discontinue supporting new leases, installations and product shipments. Analysts, too, are reportedly of the opinion that the company is likely to be out of business soon, with Guggenheim Securities cutting the price target on the stock to zero and predicting that the stock may be delisted soon.

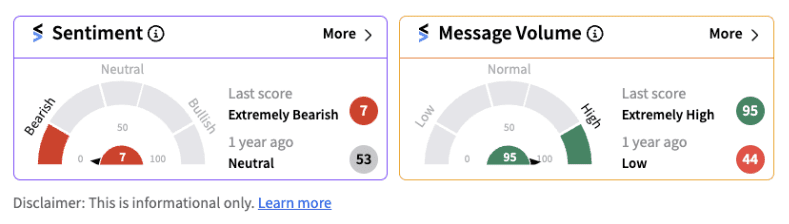

Following the report, retail investor sentiment touched a one-year low, dipping into extremely bearish territory (7/100) supported by high chatter.

Guggenheim analyst Joseph Osha reportedly wrote in a research note that the firm is entering a wind-down process that will likely end in the sale of its remaining assets and the delisting of its equity. There is also indication that the firm might be looking for alternative providers to transfer its sold projects, according to a CNBC report.

The firm did try working on its financials and cutting down costs, but has struggled to regain its footing. In April this year, the firm stated that it is moving to a low fixed-cost model that could better flex when the market is up or down. It said it is winding down its SunPower Residential Installation (SPRI) locations and closing SunPower Direct sales. Apart from these measures, SunPower also said it will be reducing its workforce by approximately 1,000 people to better align the business with its new focus.

Last month, the company said it has drawn upon a $50 million second tranche of the $175 million second lien term loan from Sol Holding. Sol Holding, which is owned jointly by affiliates of TotalEnergies SE and Global Infrastructure Partners, is the majority owner of SunPower's common stock. SunPower agreed to issue warrants to Sol Holding to purchase up to approximately 33.40 million shares of common stock at an exercise price of $0.01 per share.

Despite these steps, it seems the firm has not been able to complete its intended comeback. For now, investors on Stocktwits are debating the merit of these analyst predictions and chiming in with their own, overwhelmingly bearish commentary. Meanwhile, some traders believe a short-term bounce could be in order due to the shares’ swift drop.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)