Advertisement. Remove ads.

Elevance Health, Equifax, Liberty Oilfield Services: Retail Turns Most Bearish On These 3 Stocks

Elevance Health Inc. ($ELV)

Shares of Elevance Health dropped to levels not seen in nearly three years on Thursday after mixed Q3 results. Revenue of $45.11 billion beat estimates of $43.47 billion, but adjusted EPS came in at $8.37, well below the $9.66 expected.

The decline in earnings was linked to Medicaid challenges, with medical membership falling by 1.5 million due to eligibility redeterminations.

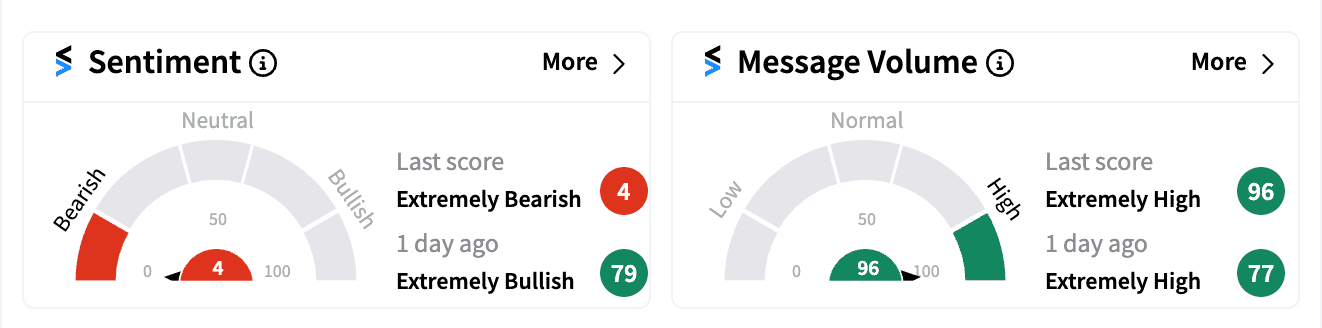

Despite pre-market bullishness, retail sentiment on Stocktwits plummeted to ‘extremely bearish’ (4/100) levels.

Equifax, Inc. ($EFX)

Equifax shares were down more than 2% on Thursday after delivering an adjusted EPS beat in Q3, though revenue only matched estimates. The company’s Q4 guidance fell short of expectations, with forecasted adjusted EPS of $2.08-$2.18 versus the consensus of $2.20.

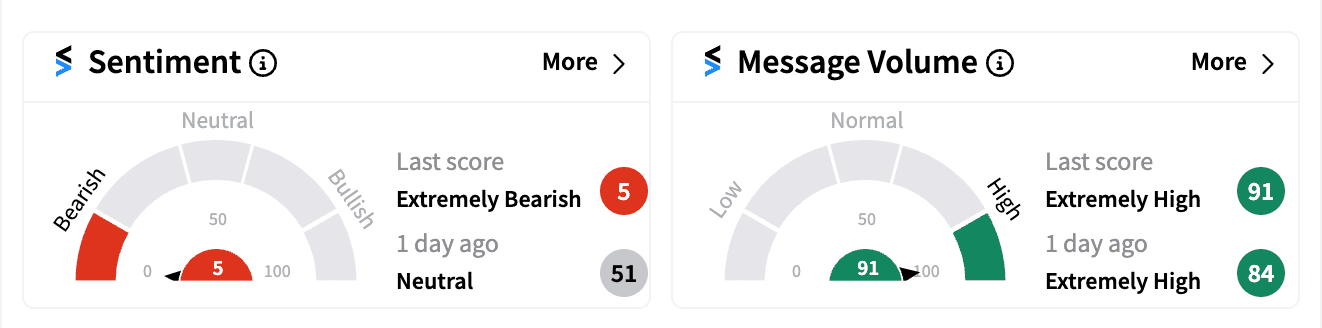

Retail sentiment on Stocktwits dropped to a year-low ‘extremely bearish’ (5/100) level.

Liberty Oilfield Services Inc. ($LBRT)

Liberty Oilfield Services late on Wednesday reported Q3 net income of $73.8 million and revenue of $1.14 billion, meeting forecasts. However, EPS came in at 44 cents, below the consensus of 58 cents, and the company forecasted a double-digit decline in Q4 activity due to uncertainty in energy markets.

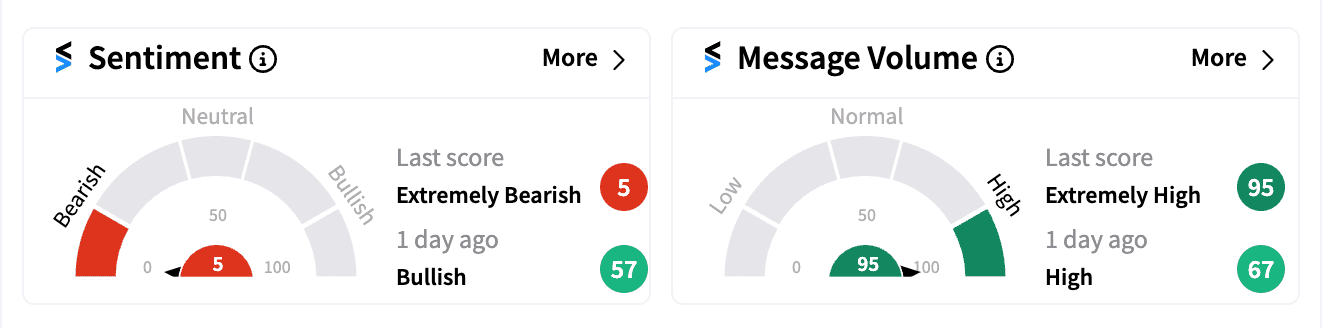

Retail sentiment on Stocktwits hit ‘extremely bearish’ (5/100) levels as the stock price fell more than 8% on Thursday.

Read next: ASML Stock Draws Maximum Jump In Retail Eyeballs As Analysts Get Bearish On Gloomy Outlook

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/10/pg-hygiene-2024-10-1758fd0b5cd7355b37bdcee639ae3b9c.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2022/12/Asian-Paints.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/2025-09-01t102230z-1330264643-rc2tggavkfan-rtrmadp-3-india-economy-tax-2025-09-59bc981d166ef04b87ddaa420db4400d.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/gst-new-2025-09-ab01588cdd4ac9aa6e2fb4224e3a0e5b.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/06/udaipur-marriott-hotel-2025-06-c90ea0b4643ce396939f588235726d62.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/gst-2025-09-8e3e802cf9336791ed2a213f0ab5610d.jpg)