Advertisement|Remove ads.

Elevance Health Stock Drops After Profit Miss On Medicaid Challenges, Retail Remains Optimistic

Shares of Elevance Health, Inc. ($ELV) fell nearly 13% pre-market Thursday following mixed Q3 results, even as retail investors remained calm.

While revenue rose to $45.11 billion, beating Wall Street estimates of $43.47 billion, adjusted earnings came in at $8.37 per share, well below the expected $9.66.

The drop in earnings was linked to Medicaid challenges, with medical membership falling by 1.5 million to 45.8 million. This decline stemmed from eligibility redeterminations and changes in Medicaid coverage across certain states.

Since early 2023, over 25 million people have reportedly been disenrolled from Medicaid, following the expiration of pandemic-era policies that previously kept them enrolled.

Despite these headwinds, CEO Gail Boudreaux expressed confidence that Medicaid rates would align with members’ needs over time.

The company expects adjusted 2024 EPS to be about $33, down from a previous forecast of $37.20, largely due to the Medicaid-related timing mismatch.

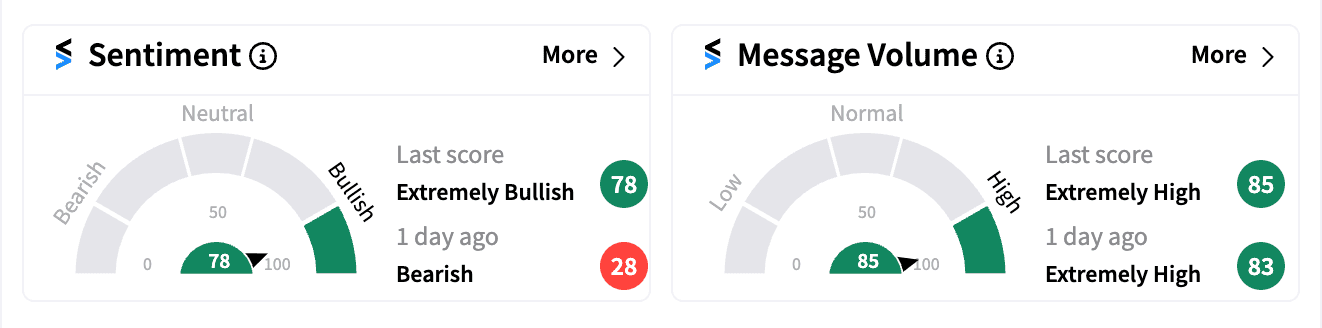

On Stocktwits, however, retail sentiment remained ‘extremely bullish’ early on Thursday amid increased message volume.

Some users pointed to Elevance’s growing operating income and reduced expenses despite the Medicaid-related challenges.

Another user noted the short-term pullback, suggesting buyers would reappear at lower levels.

Adding to the optimism, Elevance’s board approved an $8.0 billion boost to its share repurchase program. The company intends to utilize this over a multi-year period, depending on market conditions.

Elevance’s stock is up more than 3.5% year-to-date.

Read next: Capricor Therapeutics Stock Slides After Pricing Secondary Offering, Catches Retail’s Eye

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233660867_jpg_2fb83a8353.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232382206_2_jpg_b9cb73c2eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_OG_jpg_9d414a2458.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elon_musk_2_jpg_bde5f49fc6.webp)