Advertisement|Remove ads.

Retail Sentiment Spikes Most For NextEra, AgEagle Aerial, Vertiv Stocks In Mid-Day Trading

NextEra Energy ($NEE):

NextEra Energy reported mixed third-quarter results on Wednesday, with earnings beating Wall Street estimates, but revenue falling short. The company added around 3 gigawatts of new renewables and storage projects to its backlog, noting a strong storage origination quarter. Additionally, it secured new framework agreements with two Fortune 50 customers.

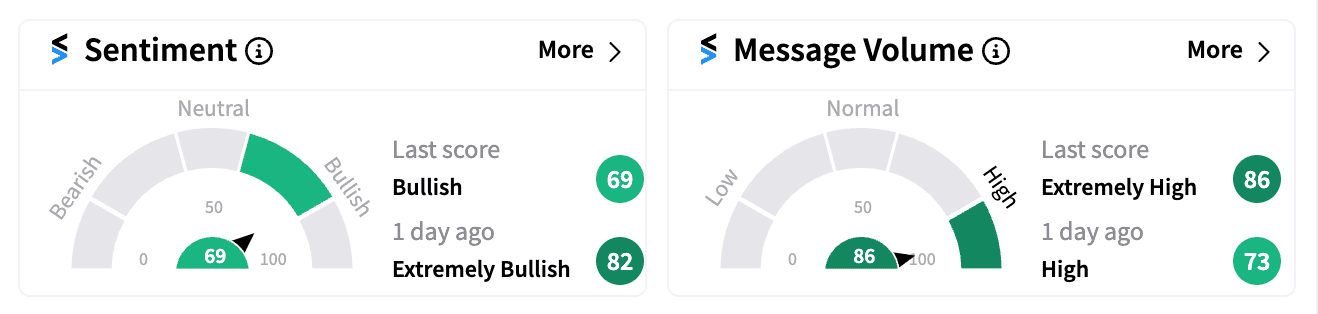

On Stocktwits, retail sentiment was ‘bullish’ (69/100), with message volume surging to ‘extremely high’ levels as investors focused on the company’s growth in renewables.

AgEagle Aerial Systems ($UAVS):

Following a series of resignations, including the Chief Financial Officer and three directors, AgEagle’s CEO reassured shareholders on Tuesday that the company is “on the correct path” to enhance long-term shareholder value. Despite the leadership shake-up, the drone manufacturer clarified that the departures were not due to disputes.

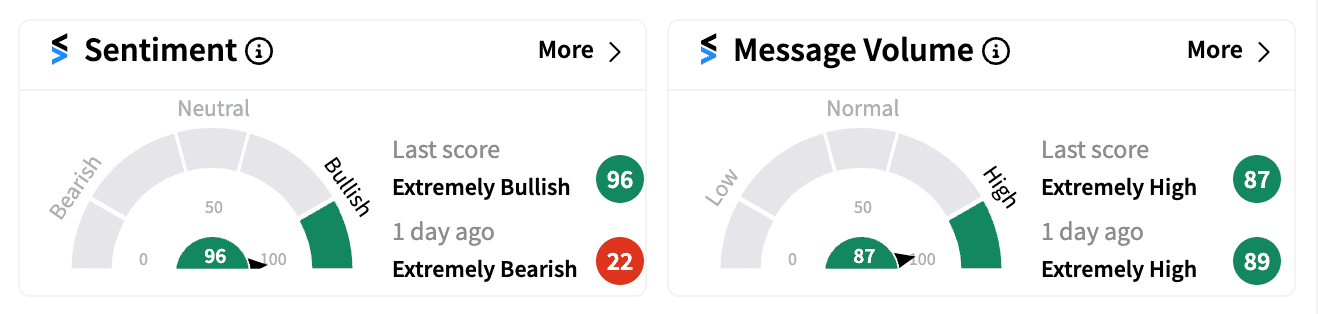

On Stocktwits, sentiment for UAVS was ‘extremely bullish’ (96/100), with message volume spiking as retail investors appeared optimistic about the company’s future.

Vertiv Holdings Co. ($VRTX):

Vertiv, a provider of power, cooling, and IT infrastructure solutions, reported an earnings beat for the third quarter but issued a tepid revenue outlook for the fourth quarter. This weighed on the stock’s performance mid-day on Wednesday, pushing shares lower.

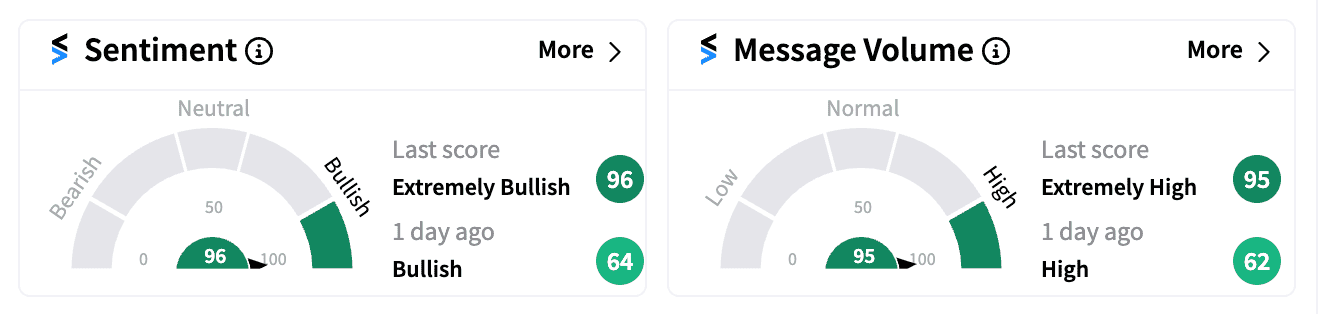

However, retail sentiment tilted into ‘extremely bullish’ levels despite the cautious outlook.

For updates and corrections email newsroom@stocktwits.com

Read next: Hilton Stock Drops After Q3 Revenue Miss, Weak Guidance: Retail Mood Crashes

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/04/rich-money-2025-04-f0b4073db42c6bc97979f963f46d5013.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/03/filter-coffee.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/sbi-2024-08-3d512e93ea6e88c29c9d7f4713260a92.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/metal-and-mining-2025-10-7f1cf8d6ed7a5d31e2971be9b93f8539.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/2025-10-24t181332z-2012779548-rc2hihawafmm-rtrmadp-3-grindr-m-a-2025-10-eb89b2d5d1b2c7ee27da768ccd3a2e66.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/jane-2-2025-10-0cb531b3a4a4595817838ded781057b1.jpg)