Advertisement|Remove ads.

Vertiv Stock Dips Despite Strong Beat-And-Raise Quarter: Retailers Maintain Bullish Outlook

Vertiv Holdings Co. ($VRT), a provider of power, cooling and IT infrastructure solutions and services, reported a third-quarter earnings beat but its fourth-quarter revenue guidance was lukewarm.

The cautious revenue outlook apparently weighed down on sentiment, sending the shares lower in premarket trading.

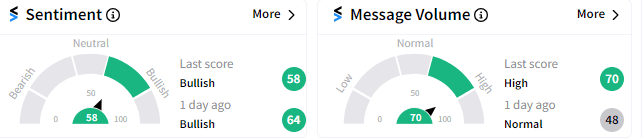

Retail sentiment has remained largely unaffected and continues to be ‘bullish’ (58/100) on Stocktwits premarket, while message volume has surged to ‘high’ (70/100) levels.

Retailers haven’t given up their hope on Vertiv, which has worked along with Nvidia Corp. ($NVDA) in building data centers. They expect the stock to come back up stronger.

Vertiv reported adjusted earnings per share (EPS) of $0.76, ahead of the $0.69 consensus estimate. Revenue came in at $2.07 billion, also exceeding Wall Street’s forecast of $1.98 billion.

The company raised the fourth-quarter and full-year guidance, citing sequential pipeline growth every quarter in 2024.

It projected fourth-quarter revenue guidance of $2.12 billion to $2.17 billion, whose midpoint falls slightly below expectations of $2.15 billion, as reported by Yahoo Finance.

The fourth-quarter adjusted EPS guidance as well as the full-year revenue guidance, however, surpassed expectations.

In premarket trading, as of 9:12 a.m. ET, Vertiv stock fell 7% to $104.60.

Read Next: Snapchat Parent's Retail Sentiment Turns Bullish As Analyst Upgrade Boosts Stock Pre-Market

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)