Advertisement|Remove ads.

Ryanair Profits Nearly Halve In June Quarter: But Retail Bets On A Turnaround

Shares of Europe’s largest airline Ryanair Holdings fell nearly 14% during Friday’s pre-market session after the firm reported a 46% year-over-year (YoY) decline in its first quarter profits at €360 million (~$392 million). The airline said that despite a 10% rise in traffic, profit was hit as the key Easter holiday fell in the previous quarter and this quarter’s airfares remained weaker than expected.

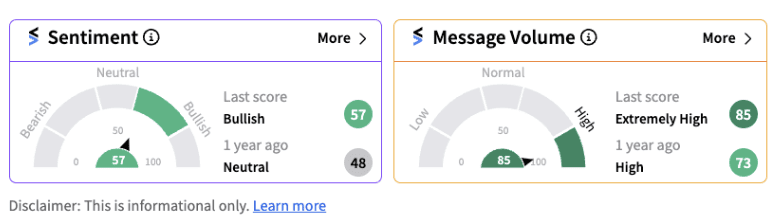

Even amid the lackluster earnings report, retail investors on Stocktwits remained bullish (57/100) supported by extremely high message volumes.

Ryanair said that total revenue declined 1% to €3.63 billion while operating costs increased 11% to €3.26 billion, marginally ahead of traffic growth. Meanwhile, average fare fell by 15% YoY €41.93.

The airline expects FY25 traffic to grow 8% from 198 million to 200 million passengers, if Boeing delivery delays do not worsen. Ryanair also believes that while second quarter demand is strong, pricing remains softer than its expectations due to higher domestic capacity. It now anticipates Q2 fares to be materially lower than last summer vs. its earlier expectation of flat to modest gains.

On the positive side, the airline is operating its largest ever schedule this summer, with over 200 new routes and five new bases.

Ryanair Group CEO Michael O’Leary said In the last 10 days of June, the airline suffered a significant deterioration in European ATC capacity which caused multiple flight delays and cancellations, especially on first wave morning flights. This makes it “more urgent than ever that the new EU Commission and Parliament deliver long delayed reform of Europe’s hopelessly inefficient ATC services,” he said in a statement.

Following the disappointing earnings announcement, shares of other European airlines also took a hit. Shares of easy Jet and Wizz Air Holdings fell over 8% on Monday. International Consolidated Airlns Grp, which runs British Airways, also dipped more than 3%.

With today’s decline, Ryanair shares are now down more than 20% YTD and over 35% from their all-time highs set in April. Still, retail investors remain bullish on the travel portion of the economy and are betting that shares will regain altitude at some point in the near future.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2049107660_jpg_906b4acd1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203496924_jpg_18e024f0e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2195819624_jpg_841341254c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_72608012_jpg_3da2f4e2a2.webp)