Advertisement|Remove ads.

Earnings Preview: Tilray Brands, Beyond Inc. and McDonald’s Report Monday — What Retail Is Thinking

Stocktwits sentiment suggests investors are optimistic about McDonald’s prospects, but lack confidence in Tilray Brands and Beyond Inc.’s ability to deliver strong earnings results on Monday.

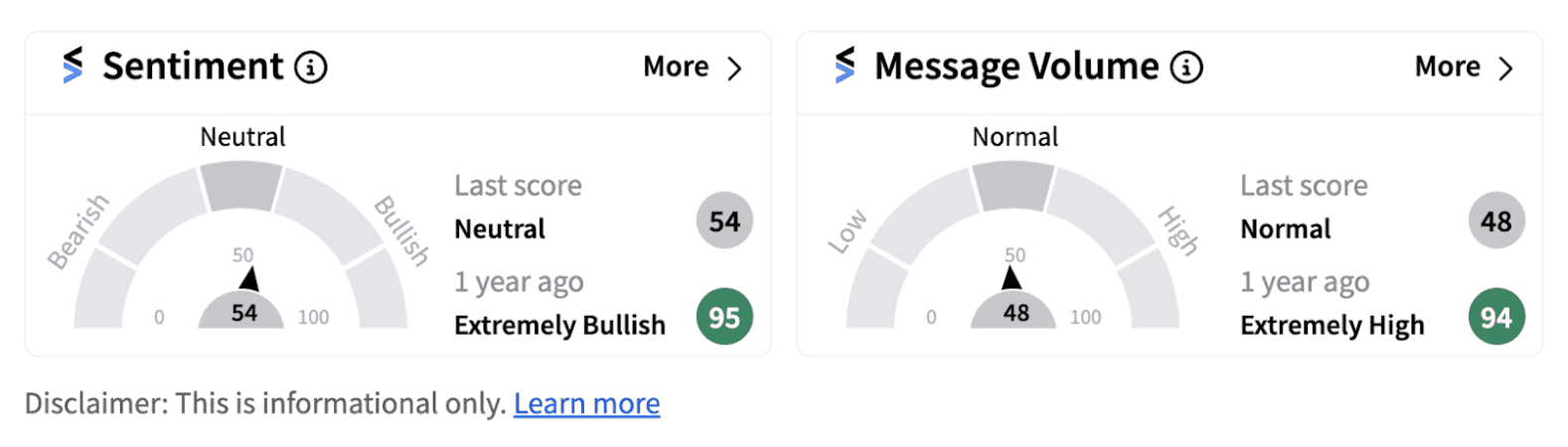

1. Tilray Brands Inc: According to a Street estimate, the cannabis-lifestyle and consumer packaged goods is expected to announce earnings per share (EPS) of (-$0.01) and revenue of $226.94 million when it reports pre-market on Monday. Retail investors have turned cautious on the stock ahead of the announcement with the sentiment meter dipping into neutral territory (54/100) from the bullish zone a day earlier.

Recently, the firm’s Germany cannabis cultivation facility, Aphria RX GmbH received the first new cannabis cultivation license issued under MedCanG, Germany’s new Cannabis Act. This allows Aphria RX to cultivate and manufacture a broad commercial range of medical cannabis.

However, retail investors remain concerned about the uncertainty around cannabis policies in the backdrop of US elections. Both Kamala Harris and Donald Trump are reportedly known to have displayed mixed stances on cannabis, leading to investor concern about what could materialize once the elections are over.

2. Beyond Inc: The online retailer, which owns Overstock, Bed Bath & Beyond, and Zulily, is expected to report second quarter EPS at (-$0.83) and revenue at $382 million after the bell on Monday. Retail investor sentiment recently dipped into bearish territory (42/100) after spending much of the previous month in a bullish zone.

Recently, the company said it has reopened Overstock.com, which now has an inventory lineup that includes closeouts, liquidation, factory direct, and reverse logistics merchandise. The management said it is encouraged by accelerating revenue run-rate in the first 90 days.

Despite the positive news, retail investors appear to be maintaining caution on the stock as the firm has recently announced structural leadership changes, eliminating the co-Chief Executive roles and the dual chief merchant roles. Investors are trying to understand the impact of these changes in the firm’s earnings before changing their view.

3. McDonald's Corp: The fast food chain will report its second quarter results on Monday before the opening bell. According to a Street estimate, the firm is expected to post EPS of $3.08 on revenues of $6.63 billion. Some analysts anticipate its results and guidance will be impacted by the effects of inflation on consumer spending patterns.

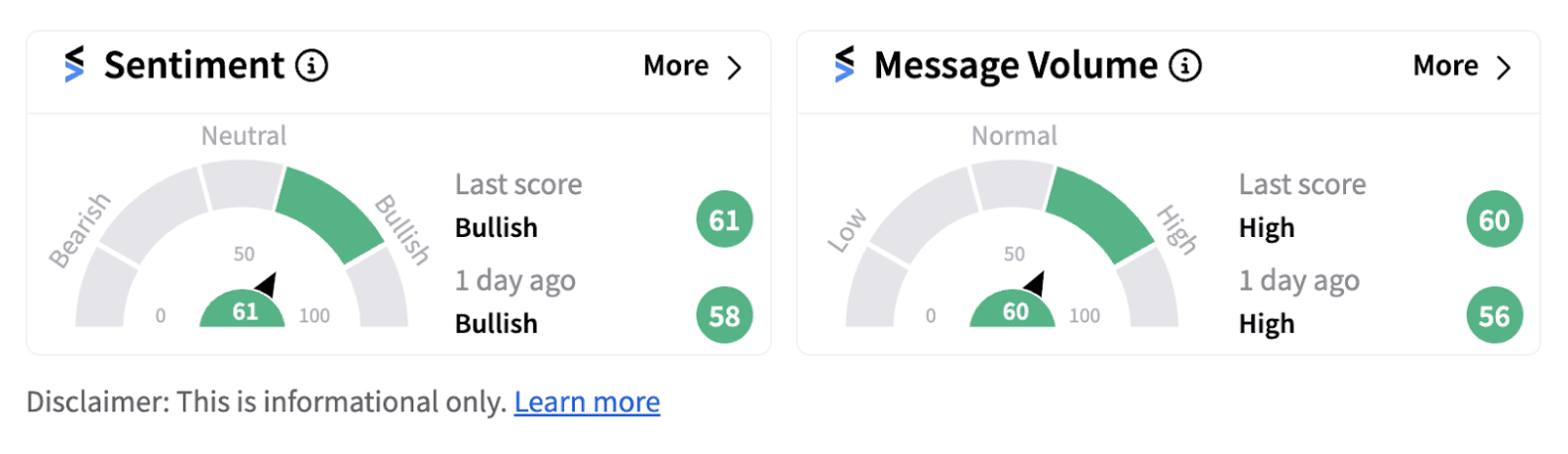

On the positive side, however, the firm is expected to make a recovery toward the second half of the year following its value meal introduction. Management remains enthusiastic about the potential increase in foot traffic due to this initiative, with 93% of its franchisees opting to extend the promotion through the end of August. Retail agrees with the optimistic take as well, with Stocktwits sentiment in bullish territory (61/100) supported by high message volume.

Photo Courtesy: Jurij Kenda on Unsplash

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hut8_logo_resized_dd54f54415.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)