Advertisement|Remove ads.

Retail Traders Call Oscar Health ‘Undervalued’ As Trump’s Obamacare Shake-Up Puts Digital Insurers In Focus

- Traders said Oscar’s strong cash position makes it well-positioned if ACA subsidies shift toward direct consumer payments.

- The company reaffirmed confidence in returning to profitability by 2026 after reporting a narrower quarterly loss and issuing upbeat FY25 revenue guidance.

- UBS raised its price target on Oscar Health to $12 from $11, but kept a ‘Sell’ rating.

Retail traders largely described Oscar Health as deeply undervalued over the weekend, saying the digital-first insurer could benefit from U.S. President Donald Trump’s renewed push to redirect Obamacare funds directly to the people and from its own improving fundamentals.

Deep Value And Breakout Potential?

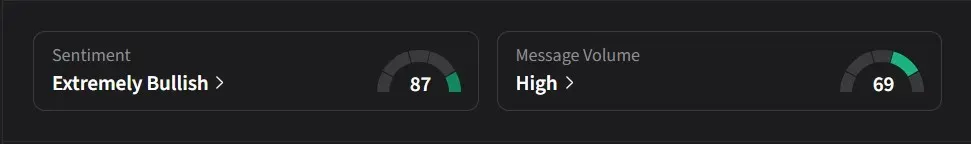

On Stocktwits, retail sentiment for Oscar Health was ‘extremely bullish’ amid ‘high’ message volume.

One user said Oscar Health stood out as the “most undervalued growth stock in healthcare,” estimating more than 150% upside and describing a multi-year cup-and-handle formation that could trigger a breakout if shares rise above $24. The same user said renewed attention on ACA subsidies could add another 20%–30% to the stock’s near-term upside, with a price target above $30.

Another user argued that Trump’s latest healthcare proposal could prove “a big win” for Oscar, saying it empowers consumer choice and benefits digital-first insurers that thrive as subsidies shift toward individual buyers.

A third user highlighted the company’s strong cash position, noting that about 75% of Oscar’s market capitalization is held in cash, pointing to a factor they said underscores its “undervalued” status. One post suggested UnitedHealth could acquire the company at around $20 per share, calling it “a hell of a deal” given the company's balance sheet strength.

ACA Policy

Trump said Saturday he is urging Senate Republicans to “send the hundreds of billions of dollars currently being sent to money-sucking insurance companies directly to the people.” The comment came as Congress moved toward a compromise to end the 40-day U.S. government shutdown without resolving the status of Affordable Care Act subsidies.

The agreement, backed by moderate Senate Democrats, would reopen several federal agencies through Jan. 30 but would exclude a full-year extension of ACA premium subsidies. Lawmakers pledged to hold a vote on the issue in December, while Democratic leaders vowed to continue pressing for protection of the expiring tax credits. Trump said the U.S. is “getting closer to the shutdown ending.”

Q3 Review

Oscar Health said Thursday it remains “confident” in its ability to return to profitability in 2026, citing disciplined pricing and expanding margins. The company forecast FY25 revenue of $12–$12.2 billion, compared with consensus estimates of $12.04 billion, and an operating loss of $200–$300 million. It reported third-quarter revenue of $2.99 billion and a net loss of $0.53 per share, narrower than expected.

On Friday, UBS raised its price target on Oscar Health to $12 from $11 but maintained a ‘Sell’ rating.

Oscar Health’s stock has risen 32% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)