Advertisement|Remove ads.

Ondas Prices $1B Stock And Warrant Offering – All Eyes Now On Investor Day

- Ondas has priced a $1 billion equity and warrant financing deal.

- The offering is priced at $16.45 per share, paired with a warrant, and $16.4499 for a pre-funded warrant plus warrant combo.

- The company will use the net proceeds to support strategic objectives like corporate development and acquisitions.

Ondas Holdings Inc. (ONDS) announced on Friday that it has set the pricing for a $1 billion equity and warrant financing deal that could provide the company with new capital for expansion.

The offering includes common stock equivalents and related warrants sold to an institutional investor.

The registered direct offering consists of 19 million newly issued ordinary shares, plus pre-funded warrants that allow the purchase of up to approximately 41 million additional shares.

In total, the package represents over 60 million common stock equivalents, each bundled with warrants that collectively grant the right to buy over 121 million additional shares.

The Pricing

The offering is priced at $16.45 per share, paired with a warrant, and $16.4499 for a pre-funded warrant plus warrant combo, reflecting roughly a 17.5% premium to the stock's closing price as of Thursday.

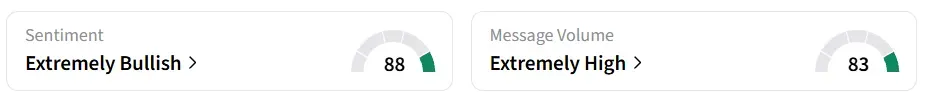

Ondas’ stock traded over 2% higher on Friday. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume.

Use Of Proceeds

Ondas anticipates gross proceeds of approximately $1 billion before fees and expenses. If all warrants were exercised on a cash basis, the company could potentially raise up to an additional $3.4 billion.

The firm said it will use the net proceeds to support strategic objectives like corporate development, acquisitions, joint ventures, and other growth opportunities.

The company has scheduled its investor day on January 16, where it will lay out its core priorities, including product development, market expansion, and how it plans to allocate capital to support growth.

Ondas develops advanced autonomous systems and private wireless technology through its units Ondas Autonomous Systems (OAS), Ondas Capital, and Ondas Networks.

ONDS stock has gained 539% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_stock_jpg_770e12377f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rocket_companies_logo_resized_jpg_1cfb06fa99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corcept_therapeutics_jpg_0778e9d4e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iova_stock_jpg_ac0924fcdd.webp)