Advertisement|Remove ads.

Benchmark Raises Rigetti Computing Price Target On ‘Increased Confidence’ In Tech Roadmap, But Retail Remains On The Sidelines

Rigetti Computing Inc. (RGTI) stock ended Friday more than 6% lower and continued falling in after-hours trading, but analysts at Benchmark see more upside following the company's recent investor call.

According to The Fly, Benchmark raised its price target for the Rigetti Computing stock to $14 from $2.50, implying an upside of over 30% from Friday’s close. The brokerage maintained its ‘Buy’ rating on the stock.

The brokerage noted that Rigetti’s investor call has “increased confidence” in the company’s product roadmap, underscoring that it sees continued progress as it looks to achieve internal fidelity targets.

Benchmark analysts are optimistic about the superconducting approach that Rigetti has undertaken. Coupled with its modular architecture, the analysts say Rigetti has “fundamental advantages to overcoming the scalability challenge in gate-based systems.”

Benchmark underscored that Rigetti is “well-positioned” with compelling architecture and a good intellectual property moat.

Earlier this month, analysts at B. Riley also hiked their price target for the Rigetti stock to $15 from $8.50 while maintaining a ‘Buy’ rating. The brokerage noted that recent industry developments should bring the stock into focus while underscoring that 2025 will be “the year to become quantum-ready.”

FinChat data shows of the six brokerage ratings for the RGTI stock, five have a ‘Buy’ rating, while there’s one ‘Outperform’ recommendation.

The average price target was $12.45, implying an upside of over 16% from Friday’s close.

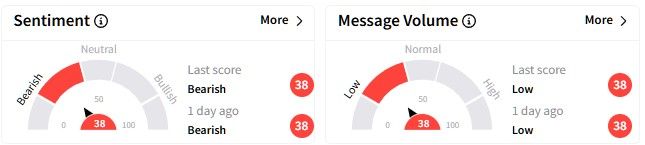

Retail sentiment on Stocktwits around the Rigetti stock remained in the negative, hovering in the ‘bearish’ (38/100) territory at the time of writing.

Rigetti’s stock has seen a parabolic rise recently, gaining more than 1,000% in the past six months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Hawaiian Electric Q4 Earnings Miss On Higher Expenses Sends Stock Sliding: Retail’s Divided

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)