Advertisement|Remove ads.

RIL Earnings Watch: SEBI RA Eyes ₹1,550 Upside On Q1 Surprise

All eyes will be on heavyweight Reliance Industries (RIL) as it reports its June quarter earnings later on Friday.

Reliance shares have declined 3% in the last week.

Analysts estimate that its oil-to-chemicals (O2C) margins will remain under pressure, driven by sluggish petrochemical demand. However, its retail and Jio segments are expected to deliver strong numbers, helping to offset the weakness in O2C.

Q1 earnings expectations

RIL’s first quarter (Q1 FY26) revenues are expected to be ₹2.30-2.35 lakh crore, compared to ₹2.31 lakh crore in the same quarter last year (Q1 FY25). Net profit is seen at ₹17,800 to ₹18,200 crore, compared to ₹18,258 crore (YoY).

EBITDA is likely to come in between ₹41,500 – ₹42,000 crore compared to ₹41,982 crore (YoY).

Oil-to-Chemicals (O2C) Segment

Refining margins have softened globally, while lower crude oil prices are likely to weigh on its topline numbers. Additionally, petrochemical demand too remains sluggish.

Jio (digital services) Segment

Subscriber additions of 8-9 million are expected. The Average Revenue Per User (ARPU) is likely to see a marginal increase to ₹183–185, even as 5G rollout costs remain elevated.

Retail Segment

Strong festive and off-season demand, along with store expansion and footfall, remain the key factors to watch. EBITDA margin may surprise on the upside.

RIL stock: What next?

According to SEBI-registered analyst Varunkumar Patel, the RIL stock is currently trading below its 20-day Exponential Moving Average (EMA), indicating weakness in the near term. Key support lies in the ₹1,450–₹1,455 zone.

Additionally, its Relative Strength Index (RSI) is below 50, signaling bearish momentum. And low volume participation suggests a lack of investor interest at current levels, Patel added.

A positive surprise in Q1 margins & Jio ARPUs could trigger a rally in RIL to ₹1,550 and higher. However, if O2C performance lags too much, expect selling pressure to persist until ₹1,390, he highlighted.

With Reliance being an index heavyweight, its Q1 earnings performance could likely set the tone for broader market sentiment.

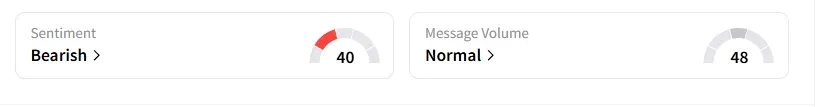

Data on Stocktwits shows that retail sentiment is ‘bearish’ on this counter.

Reliance shares have risen 21% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)