Advertisement|Remove ads.

Rivian Automotive Stock Slides 8% Pre-market After Firm Slashes Annual Production Guidance: Retail’s Skeptical

Shares of Rivian Automotive Inc (RIVN) slid over 8% during Friday’s pre-market session as of 6:38 a.m. ET as the electric vehicle-maker reduced its full year production guidance due to shortage of components.

The Amazon-backed (AMZN) firm said it is revising its annual production guidance to the range of 47,000 and 49,000 vehicles compared to an earlier forecast of 57,000 vehicles.

The firm said it is experiencing a production disruption due to a shortage of a shared component on the R1 and RCV platforms. “This supply shortage impact began in Q3 of this year, has become more acute in recent weeks and continues,” it said in a statement.

For the quarter ending Sept. 30, 2024, Rivian produced 13,157 vehicles at its manufacturing facility in Illinois and delivered 10,018 vehicles.

The company reaffirmed its annual delivery outlook of low single digit growth as compared to 2023, which puts the figure between 50,500 and 52,000 vehicles.

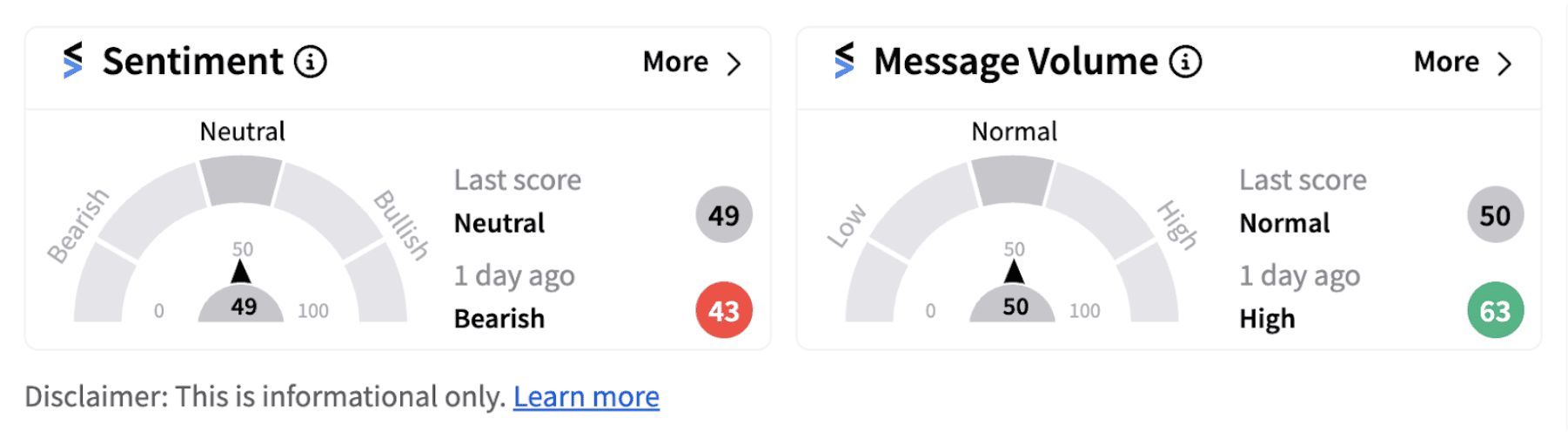

Following the announcement, Rivian became the fifth most trending stock on Stocktwits. Despite the pre-market decline, retail sentiment for RIVN inched up into the ‘neutral’ territory (49/100) from the ‘bearish’ zone a day ago.

Some users with a bearish outlook on the stock have expressed skepticism. For instance, one user questioned the logic behind the revision in guidance just because of the shortage of a “single component.”

Another user expects the stock might hit the $8 mark.

Rivian’s stock witnessed some respite in the last few months after Volkswagen announced a joint venture with the firm, under which the German auto giant will invest $1 billion initially and has up to $4 billion of planned additional investment.

However, given the fact that the automotive industry has been going through a tough time in the wake of high interest rates and intensifying competition, it’s not surprising that the stock lost over 48% this year.

If Friday’s stock price fall sustains, investors will be watching out for the stock’s potential movement toward its life-time lows near the $8.30 mark.

The company, meanwhile, notified it will release its third-quarter earnings on Nov. 07 after the market close.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)