Advertisement|Remove ads.

Rivian Stock Gets Price Target Hike From Mizuho: Retail Stays Extremely Bullish

Shares of Rivian Automotive Inc. (RIVN) traded 3% higher on Friday afternoon after Mizuho Securities raised its price target on the stock to $13 from $11 while keeping a ‘Neutral’ rating.

The new price target, however, represents a 15% downside to the company's closing price of $15.30 on Thursday.

The brokerage hiked its price target on the EV company over the rollback of most tariffs on China by the U.S. earlier this week.

U.S. and China agreed on Monday to pause the bulk of the tariffs for the next 90 days while further trade talks occur.

As part of the truce, the combined 145% tariffs on most Chinese imports into the U.S. will be reduced to 30% overall. Meanwhile, China’s tariffs on U.S. imports will decrease to 10%.

The brokerage said it sees the 90-day truce as positive for macro demand and electric vehicle parts imports. However, it noted that lower EV subsidies are a challenge, as per TheFly.

Mizuho also hiked its price target on General Motors (GM) to $58 from $53 and on Tesla Inc. (TSLA) to $390 from $325 over the rollback of tariffs.

According to data from Koyfin, 17 of 29 analysts covering Rivian rate it a ‘Hold’, nine rate it a ‘Buy’ or ‘Strong Buy’, and three rate it a ‘Strong Sell’. The average price target for the stock is $14.34.

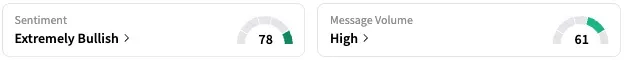

On Stocktwits, retail sentiment around Rivian stayed within the ‘extremely bullish’ territory over the past 24 hours while message volume remained at ‘high’ levels.

A Stocktwits user expressed optimism about the company’s upcoming R2 SUV.

The company’s current R1 vehicle offerings have a starting price around $70,000 and are aimed at a more premium customer base.

RIVN stock is up by about 19% this year and over 55% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)