Advertisement|Remove ads.

RIVN Stock Surges 20% Pre-Market On Upgrade: Analysts See Edge With Rivals ‘Slow-Walking’ EV Transition

- Deutsche Bank upgraded Rivian to ‘Buy’ from ‘Hold’ and raised its price target to $23 from $16.

- UBS said it remains “excited” about Rivian’s product pipeline and brand strength.

- Earlier, Rivian said the rollout of its R2 SUV is likely to weigh on margins in the first half of 2026.

Rivian Automotive Inc. (RIVN) shares jumped more than 20% in pre-market trading on Friday, driven by upbeat brokerage reactions to the electric vehicle maker’s stronger-than-expected fourth-quarter results, highlighted by its first-ever quarter of achieving a positive gross margin on a cash basis.

The rally signals renewed investor confidence in Rivian’s path to profitability at a time when several legacy automakers appear to be slowing their EV ambitions.

Rivian Delivers Revenue Beat, Margin Milestone

On Thursday, Rivian reported Q4 revenue of $1.29 billion, driven by higher software and services revenue from its joint venture with Volkswagen Group. Wall Street had estimated a revenue of $1.27 billion, according to Fiscal.ai data. The company also reported a loss of $0.66 per share, marginally narrower than the $0.67 per share estimate.

R2 SUV Rollout May Pressure Margins In Short-Term

Rivian said the rollout of its lower-priced R2 SUV is likely to weigh on margins in the first half of 2026 as production ramps up, but is expected to turn into a tailwind by the fourth quarter as manufacturing scales. R2 is expected to become the majority of the company’s vehicle volume by the end of 2027.

Deutsche Bank: Rivian’s 2026 Trajectory Appears De-Risked

Deutsche Bank upgraded Rivian to ‘Buy’ from ‘Hold’ and raised its price target to $23 from $16, according to The Fly. This represents a 64% upside to the stock’s $14 closing price on Thursday. The brokerage highlighted early signs of an improving outlook, noting that Rivian’s 2026 trajectory appears “de-risked,” supported by achievable volume expectations and continued progress in reducing vehicle costs.

Deutsche noted that Rivian’s R2 vehicle launch is on track for Q2, while competitors are “slow-walking” their EV transitions. The firm also believes the stock offers an attractive risk-reward profile.

UBS Turns Less Bearish On Rivian

Meanwhile, UBS upgraded Rivian to ‘Neutral’ from ‘Sell’ and raised its price target to $16 from $15. The firm noted that Rivian’s near-term risk-reward profile now appears more balanced at current levels, compared with its previously bearish view that was partly driven by valuation concerns.

UBS added that it remains “excited” about Rivian’s product pipeline and brand strength, and believes the company’s 2026 guidance captures meaningful upside potential while accounting for downside risks.

How Did Stocktwits Users React?

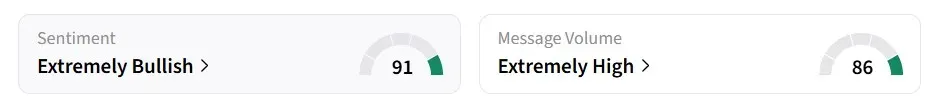

Retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a day earlier, amid ‘extremely high’ message volumes. RIVN was among the top trending tickers at the time of writing.

One bullish user expects 2026 to be Rivian’s breakout year.

However, another user expects the company to be raising funds urgently over the next couple of years.

Year-to-date, the stock has shed over 14%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)