Advertisement|Remove ads.

Rivian’s $250M IPO Settlement, Layoffs Aim To Refocus Company On R2 Launch — But Retail Remains Skeptical

- Rivian agreed to pay $250 million to settle investor claims related to its 2021 IPO, funding the payout through insurance and cash reserves.

- The EV maker is cutting about 600 jobs, or 4.5% of its workforce, as part of a restructuring effort ahead of its 2026 R2 SUV launch.

- Retail traders on Stocktwits described sentiment as “neutral,” voicing concerns over cash burn, slowing demand, and repeated layoffs.

Rivian Automotive Inc. said Thursday it has reached an agreement to settle the 2022 securities class action lawsuit filed in the U.S. District Court for the Central District of California, resolving claims that the company misled investors about vehicle pricing during its 2021 IPO.

If approved by the court, the settlement would see Rivian pay $250 million to investors who bought its Class A shares between November 2021 and March 2022. The company said it plans to fund the payment through $67 million in directors’ and officers’ liability insurance and $183 million in cash on hand.

Rivian reiterated that the settlement “is not an admission of fault or wrongdoing,” adding that the decision allows it to concentrate resources on future operations. “Settling will enable Rivian to focus its resources on the launch of its mass-market R2 vehicle in the first half of 2026,” the company said in a statement.

Case Background

The lawsuit alleged Rivian did not disclose critical details regarding its product pricing and cost of production, both before and after the IPO. The plaintiffs in the lawsuit claim Rivian substantially underpriced its R1T pickup and R1S SUV at launch, then hiked prices soon after the stock began trading.

Lawyers for the plaintiffs said the $250 million settlement represented a “substantial percentage” of potential damages investors could have recovered had the case gone to trial. If approved, the agreement will resolve all claims against Rivian and its executives.

Workforce Cuts

Rivian’s decision to settle comes as the company undertakes cost-cutting measures ahead of the R2’s debut, which is a smaller, more affordable SUV slated for launch in the first half of 2026. CEO RJ Scaringe said in an internal memo that the automaker is eliminating about 600 jobs, or 4.5% of its workforce, as part of structural adjustments ahead of the R2 launch and to profitably scale, according to a Bloomberg report.

The company is also reorganizing functions under a single marketing organization, which Scaringe will lead on an interim basis. The cuts focus on commercial roles across servicing and sales as Rivian streamlines operations amid weaker U.S. EV demand and higher import tariffs.

Stocktwits Traders Turn Cautious On Cash Burn Concerns

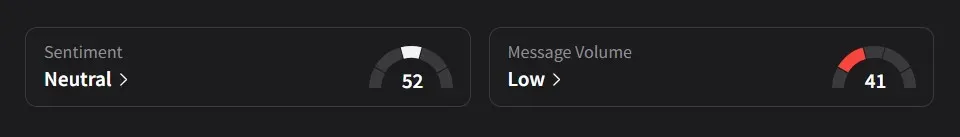

On Stocktwits, retail sentiment for Rivian was ‘neutral’ amid ‘low’ message volume.

One user on Stocktwits expressed concern that Rivian had announced two rounds of layoffs this year, questioning what next year might bring as sales of the R1S and R1T continue to weaken, and added that it doesn’t look like a bright future.

Another user criticized the company’s spending, saying Rivian was “burning cash for the wrong reason” and warning that it could head toward bankruptcy, citing layoffs and supply chain issues before the R2 launch, as well as a lack of serious buyers.

Rivian’s stock has declined nearly 2% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)