Advertisement|Remove ads.

Rivian’s Risks ‘Piling Up,’ Says BofA Analyst — But Retail’s Not Shaken By Downgrade

Shares of Rivian Automotive Inc. have dropped over 12% since last week's earnings report as investors grapple with weaker-than-expected delivery guidance and the risk of policy rollbacks under the Trump administration.

The stock's downturn continued Monday after BofA Securities downgraded Rivian to 'Underperform' from 'Neutral' and slashed its price target to $10 from $13, citing a more challenging outlook ahead.

According to The Fly, BofA acknowledged that Rivian remains one of the more viable electric vehicle startups, making steady progress toward sustainable gross margins.

However, the analyst warned that the 2025 outlook appeared softer than anticipated, saying Rivian's partnership with Volkswagen added complexity to long-term earnings forecasts.

Rising competition and slowing demand for electric vehicles further compound the risks, leading the research firm to conclude that risks are "piling up" for Rivian.

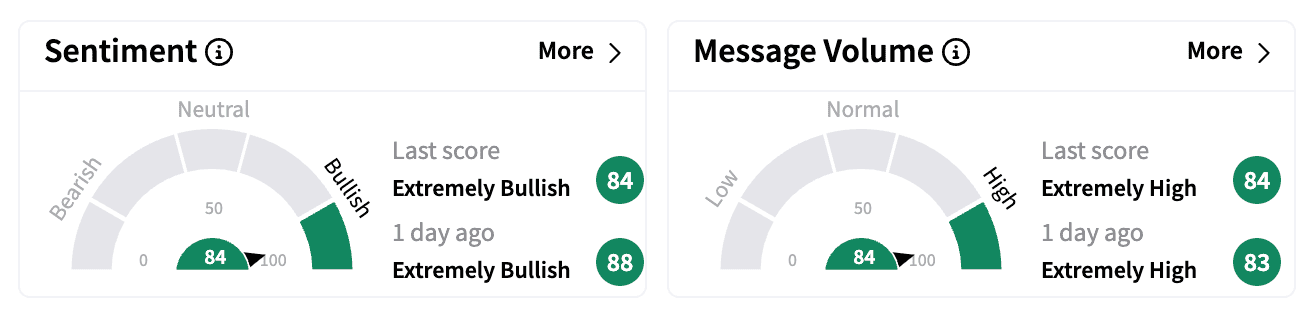

However, on Stocktwits, retail sentiment remained 'extremely bullish,' with message volume surging by 465% over the past 24 hours.

One trader pointed to Rivian's recent pattern of higher lows since its April 2024 bottom, arguing that fears over the stock's trajectory were misplaced given its push toward profitability.

Others cited CEO R.J. Scaringe's post-earnings comments to CNBC, in which he acknowledged uncertainty around tariffs and EV credits but reaffirmed his conviction that the entire auto industry would eventually transition to electric.

Not all Wall Street analysts are bearish on Rivian.

DA Davidson reportedly raised its price target to $13 from $12 on Monday, maintaining a 'Neutral' rating.

The research firm sees 2025 as a flattish year for vehicle demand but believes Rivian is ramping up marketing efforts ahead of its highly anticipated R2 launch while capitalizing on short-term R1S and R1T opportunities.

Additionally, analysts highlighted the company's growing non-vehicle revenue streams and its evolving partnership with Volkswagen as potential positives.

Guggenheim took a more cautious stance, lowering its price target on Rivian to $16 from $18 but maintaining a 'Buy' rating. The research firm pointed to weaker-than-expected delivery guidance as a key concern.

Still, it noted several catalysts ahead, including Scaringe's upcoming presentation at Nvidia's GTC conference in March and the possible rollback of leasing subsidies under Biden's Inflation Reduction Act.

Rivian shares have declined over 10% year-to-date but remain up more than 9% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)