Advertisement|Remove ads.

Rivian's Limited 'Dune' Edition Fails To Lift Stock Before Q4 Earnings, But Retail Crosses Fingers For A Strong Print

Rivian Automotive Inc.'s (RIVN) shares fell more than 3.5% on Wednesday and extended losses in after-hours trading, reflecting investor caution ahead of the company's upcoming fourth-quarter earnings.

The EV maker attempted to generate some excitement by unveiling the "California Dune" edition of its R1 electric vehicles.

The special edition features 20-inch All-Terrain wheels, a new paint color, and an underbody shield targeted at off-road enthusiasts.

It is built on Rivian's tri-motor powertrain, which delivers 850 horsepower, 1,103 lb-ft of torque, and a 0-60 mph acceleration of 2.9 seconds. The EPA-estimated range is 329 miles.

The R1T Dune edition starts at $99,900, while the R1S version is priced at $105,900, making them among Rivian's priciest offerings.

Despite the reveal, the stock remained under pressure, though retail investors appeared more optimistic.

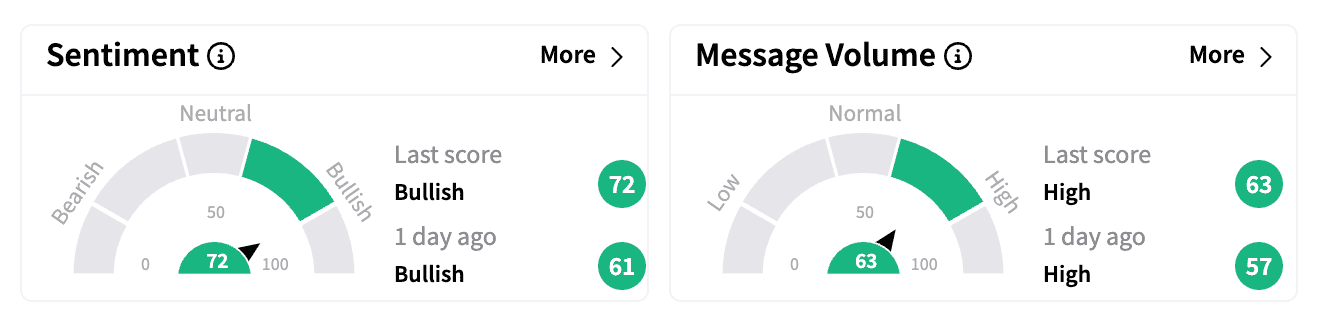

On Stocktwits, sentiment for Rivian ended on a more 'bullish' note on Wednesday than the previous day, with message volume jumping 24%.

Some traders speculated that if Rivian delivers its first profitable quarter, the stock could surge to $20.

Others dismissed bankruptcy fears, pointing to Amazon's and Volkswagen's continued support.

There has been some optimism around the company's recent move to expand commercial van sales beyond its prior exclusivity agreement with the e-commerce giant.

Short interest in Rivian last stood at 13.7%, albeit slightly lower than at the start of the year, according to Koyfin data.

Concerns persist over Rivian's unprofitability, with bears highlighting its negative margins and the fact that the company continues to lose tens of thousands of dollars per EV sold.

The political climate has also weighed on sentiment, with worries about the impact of Donald Trump's presidency on the EV sector.

There has been some relief after a federal judge blocked Trump's attempt to freeze Department of Energy loans, which includes Rivian's $6.6 billion credit secured in the final days of the Biden administration.

Investors are now watching for updates on Rivian's upcoming smaller and more affordable R2 model, which is expected to expand its customer base.

Wall Street expects Rivian's fourth-quarter adjusted losses per share to narrow to $0.68 from $1.36 a year earlier, while revenue is estimated to rise to $1.4 billion from $1.31 billion.

Rivian's stock is up more than 4% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_logal_paul_OG_jpg_3c5ff1734b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corsair_gaming_jpg_f2eebff8d4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)