Advertisement|Remove ads.

Rivian Stock Soars To 16-Month High — Citigroup Boosts Stake, Retail Traders See ‘Next-Gen’ Opportunity In R2 SUV

- Citigroup more than doubled its Rivian stake in the third quarter, bringing its holdings to 8.54 million shares worth about $125 million.

- Analysts expect Rivian’s December 11 Autonomy & AI Day to focus on driver-assist features and “personal-automobile autonomy” over full self-driving systems.

- Retail traders on Stocktwits described the R2 SUV as the company’s key milestone, comparing Rivian’s setup to Tesla’s early breakout years.

Rivian Automotive shares climbed to their highest level in nearly 16 months after Citigroup more than doubled its position in the electric vehicle maker during the third quarter. The move comes ahead of Rivian’s Autonomy & AI Day, where analysts expect a focus on practical, driver-focused artificial intelligence.

Citi’s Rivan Stake Now At 4-Year High

Citigroup more than doubled its stake in the EV manufacturer during the third quarter, marking its largest holding since it began investing four years ago, according to a report by EV.

The third-largest U.S. asset manager increased its position by 4.95 million shares between July and September, ending the quarter with 8.54 million shares worth $125 million. Rivian’s stock has since risen 11.8%, bringing Citi’s stake to roughly $140 million as of Nov. 10.

Citigroup first opened a position in Rivian in late 2021, shortly after its IPO. Its stake has fluctuated over time, but 2025 marked a significant ramp-up, with the firm increasing its position in consecutive quarters.

Institutional Support Remains Strong

About 851 institutions now hold over 666 million Rivian shares. Amazon remains Rivian’s largest shareholder with 158 million shares, following its 2019 investment and long-term commitment to purchase more than 100,000 electric delivery vans by 2030.

Volkswagen AG, which partnered with Rivian last year in a software and platform development partnership, holds 146 million shares and has already invested $2 billion across two tranches. Additional funding of $2.46 billion is planned through 2028, potentially making Volkswagen Rivian’s largest shareholder once completed.

Vanguard Group ranks third with 81.6 million shares, valued at $1.34 billion.

Analysts See Focus On Practical AI At Upcoming Event

Rivian’s upcoming Autonomy & AI Day on Dec.11 is expected to spotlight advances in artificial intelligence and driver-assist technologies. According to D.A. Davidson analysts Michael Shlisky and Linda Umwali, the event will emphasize “personal-automobile autonomy,” pointing to features designed to improve everyday driving rather than full self-driving systems.

The analysts noted that Rivian’s driver-assist features have already resonated with buyers seeking vehicles that are “fun to drive.” They added that while the company has made progress in offsetting tariff-related costs, the stock could remain rangebound until there’s greater clarity on the R2 SUV launch, Volkswagen partnership milestones, and improvements in gross margins and EBITDA losses.

CEO Incentives Tied To Growth And Profitability

The rally also follows Rivian’s approval of a new 10-year performance-based compensation plan for CEO RJ Scaringe, potentially worth up to $4.6 billion if long-term operational and share-price targets are achieved.

The package, which doubles Scaringe’s base salary to $2 million, links incentives to profitability, free cash flow, and stock performance through 2032. The board said the plan aims to retain Scaringe’s leadership as Rivian scales production and prepares to launch its lower-cost R2 SUV in 2026.

Stocktwits Traders See R2 As Rivian’s Defining Moment

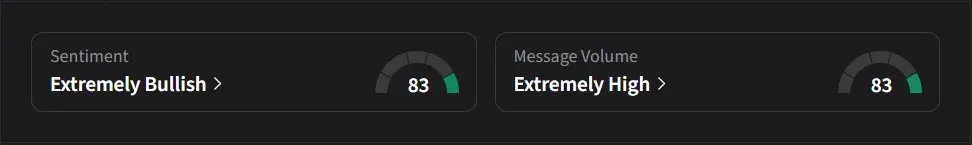

On Stocktwits, retail sentiment for Rivian was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said they were regaining confidence in Rivian, noting that short-term events like the upcoming AI Day matter less than the company’s execution on its R2 SUV. They added that if Rivian delivers on that milestone, it could become a long-term investment “to pass on to the next generation.”

Another user cautioned that once Wall Street recognizes the company’s value, “they won’t let you have it for cheap,” recalling their regret over selling Tesla shares before its major breakout more than a decade ago.

Rivian’s stock has risen 35% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)