Advertisement|Remove ads.

Rivian Stock Tumbles As R2 Buzz Wears Off: Analyst Warns SUV Launch Faces ‘Significant Risks’ Without Flawless Execution

- Analysts flagged concerns about a softer R1 outlook and a challenging EV demand backdrop.

- DA Davidson downgraded the stock to ‘Underperform’ with a $14 target, implying 15% downside, warning R2 must be “the best mid-size EV launch since 2021.”

- Rivian said R2 will pressure margins in early 2026, with scaling later in the year, and deliveries expected to reach 62,000-67,000 this year.

Shares of Rivian Automotive, Inc. (RIVN) slid Tuesday as early excitement around its R2 SUV cooled and Wall Street shifted focus to execution risks and a tougher EV demand backdrop.

RIVN stock tumbled over 7% on Tuesday to hit $16.47, marking its weakest session in nearly a month.

Wall Street View On Rivian’s R2 SUV

DA Davidson downgraded Rivian to ‘Underperform’ from ‘Neutral’ on Tuesday, cutting its price target to $14 from $15, which implies 15% downside from current levels. The brokerage said the initial rally was driven by the "positive tone" of the R2 launch. However, the firm said that the R1 outlook was below its expectations and warned that R2 rollout is “not without significant risks.”

DA Davidson added that for Rivian to justify its current outlook, the company would need to deliver “the best mid-size EV launch since 2021,” despite lacking federal EV tax credits and a mass-market dealer network.

Meanwhile, Stifel raised its price target to $20 from $17, implying a 21% upside from the stock's last close, and reiterated a ‘Buy’ rating on Tuesday. The brokerage firm said Rivian’s fourth-quarter (Q4) report and outlook were positive and “underscore the company’s strong progress on several fronts.”

Last week, Mizuho raised its price target on Rivian to $11 from $10 but maintained an ‘Underperform’ rating, citing a still-challenged EV demand backdrop.

On the other hand, Cantor Fitzgerald said the R2 launch, combined with Rivian’s AI-driven customer focus and strategic partnerships with Amazon and Volkswagen, could help boost demand, improve unit economics, and position the company to capture additional EV market. However, Cantor said that the near-term outlook remains neutral pending more clarity on customer uptake and autonomy timelines.

R2 Rollout Adds Pressure To Margins

The company has also been clear that the R2 launch will pressure margins in early 2026. On Rivian’s Q4 earnings call, CFO Claire McDonough said the “complexity” of launching R2 is expected to weigh on automotive gross profit in the first half of 2026, before turning into a tailwind later in the year as production scales.

CEO RJ Scaringe said R2 production will begin on a single shift at Rivian’s Normal, Illinois plant, with a second shift planned for late 2026 and a third in 2027, depending on supplier readiness.

Sentiment was further weighed down by signs that Rivian has delayed its international R2 rollout. The company removed a previously stated 2027 Europe launch target from its website, replacing it with a generic “coming to Europe” message. In Canada, the R2 is now listed as “coming 2027,” later than the earlier 2026 timeline, and pricing information has been removed. However, U.S. plans remain unchanged, with full pricing and specifications due on March 12.

Rivian Bets On R2 To Lift 2026 Deliveries

Rivian expects to deliver 62,000-67,000 vehicles in 2026, up from 42,247 in 2025, with R2 accounting for most of the growth. Deliveries are expected to remain modest early in the year, then accelerate in the second half.

The R2 SUV is expected to be priced around $45,000, well below the roughly $70,000 R1 lineup. The Launch Edition will feature dual motors, all-wheel drive, more than 650 horsepower, and over 300 miles of range. R2 will debut with Rivian’s Gen 2 autonomy stack, with major hardware upgrades, including LiDAR, planned for 2027.

How Did Stocktwits Users React?

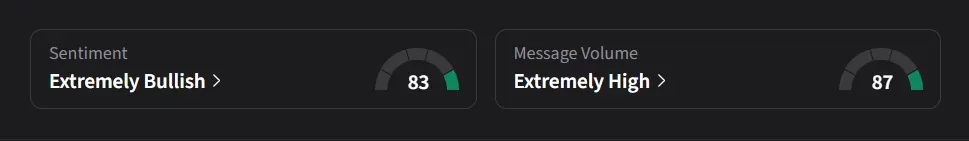

On Stocktwits, retail sentiment for Rivian was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “Legacy car owners, don’t worry if gas price touches $6 soon per gallon, you can always get R2!”

Another user said, “All the pump, 30% jump during ER and still sitting at $16. Lol I am telling you it will drop to $10 again one day.”

RIVN stock has declined 16% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUV_Southwest_bags_jpg_0c65f623c2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_automotive_jpg_e356c1abe5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)