Advertisement|Remove ads.

Rocket Companies Joining Meme Stock Frenzy? Retail Sees Mortgage Firm Taking Off To The Skies Amid Potential Short Squeeze

The recent meme stock rally found another champion on Tuesday. Mortgage firm Rocket Companies shares jumped over 8% in extended trading, as retail traders beefed up their holdings in anticipation of a surge.

At the time of writing, Rocket Companies was the top-trending ticker on Stocktwits. Retail chatter on the platform about the stock has surged 740% over the past week, with traders speculating about a potential earnings boost from its recent acquisitions and a short squeeze, a phenomenon when short sellers are forced to buy back shares to cover their positions and limit losses amid a rapid increase in share price.

The stock has gained nearly 20% over the past seven days, with year-to-date gains of approximately 50%. According to Koyfin data, the stock had a very high short interest of nearly 49%.

Rocket stock saw a spike in chatter on the Reddit forum r/wallstreetbets, which was highly influential in the “meme stock” frenzy of 2021, with one post stating, "Going in on Rocketship."

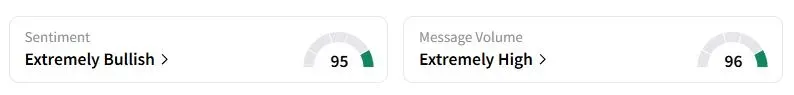

Retail sentiment on Stocktwits was in the ‘extremely bullish’ territory at the time of writing, while retail chatter was ‘extremely high.’

One user predicted the stock could surpass its all-time highs from 2021.

The company is no stranger to a meme stock rally, as it surged 71% on March 2, 2021, adding a staggering $34 billion to the company’s market valuation before plunging the following day.

Investors were also bullish about the mortgage company’s growth prospects following its multi-billion-dollar acquisitions of Mr. Cooper and Redfin. Earlier this week, Jefferies analysts noted that two deals will drive average EPS accretion over 2026-27 of 37%.

The company is scheduled to report its earnings on July 31.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)