Advertisement|Remove ads.

Rocket Companies Stock Rises After Q4 Profit Beat, Retail Sentiment Hits 1-Year High

Rocket Companies (RKT) stock gained 6.6% in aftermarket trading on Thursday after the company’s fourth-quarter earnings topped Wall Street’s estimates.

The financial technology firm reported adjusted net income of $0.04 per share, while analysts, on average, expected it to post earnings of $0.03 per share, according to FinChat data.

Its fourth-quarter adjusted revenue of $1.19 billion exceeded Wall Street’s estimated $1.15 billion.

The Detroit-based company posted a fourth-quarter net income of $649 million, or $0.23 per share, compared with a loss of $233 million, or $0.09 per share, in the year-ago quarter.

The top mortgage lender said adjusted revenue in its direct-to-consumer segment jumped to $904 million from $675 million for the same period last year.

The company's sold loan volume in this segment spiked to $16.53 billion during the quarter, up from $10.36 billion last year.

Its partner network segment adjusted revenue rose $135 million from $110 million last year.

Rocket Companies said its servicing fee income rose to about $388 million in the fourth quarter, compared to $347.7 million in the year-ago quarter.

The company said Rocket Mortgage generated $23.6 billion in net rate lock volume, a 47% increase from last year. Rate lock denotes a fixed mortgage rate agreed between the lender and borrower.

While Federal Reserve rate cuts helped lower mortgage rates in September, they began to rise again towards the end of 2024 on inflation worries.

It also said that Rocket Mortgage net client retention rate was 97% for the year ended Dec. 31.

The company forecasted first-quarter adjusted revenue between $1.18 billion and $1.33 billion.

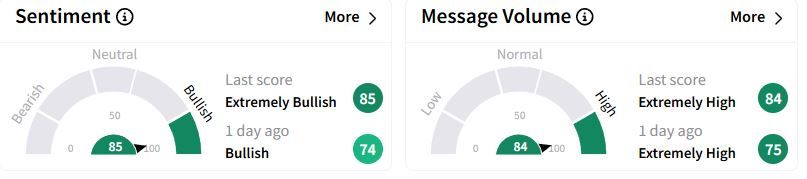

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (85/100) territory from ‘bullish’(74/100) a day ago and hit the highest score in a year, while retail chatter moved higher in the ‘extremely high’ zone.

One user hoped the stock would go back to $40 soon.

Over the past year, Rocket Companies shares have gained 10.4%.

Also See: EOG Resources Stock Falls As Q4 Revenue Falls Short Of Expectations, Retail Remains Skeptical

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)