Advertisement|Remove ads.

EOG Resources Stock Falls As Q4 Revenue Falls Short Of Expectations, Retail Remains Skeptical

EOG Resources (EOG) stock fell 1.8% in after-hours trading on Thursday after the company’s fourth-quarter revenue missed Wall Street’s estimates.

The oil and gas producer reported quarterly revenue of $5.59 billion for the three months ended Dec. 31, while analysts, on average, expected it to post $5.93 billion in revenue.

Its free cash flow fell to $1.28 billion from $1.48 billion in the year-ago quarter.

On an adjusted basis, the company reported a net income of $2.74 per share, exceeding Wall Street’s estimate of $2.56 per share.

The company said average WTI benchmark oil prices fell to $70.28 per barrel, compared with $78.33 per barrel, in the year-ago quarter.

EOG said its fourth-quarter production averaged about 1.1 million barrels of oil equivalent per day, compared with 1.03 million barrels per day in the year-ago quarter.

U.S. oil production surged to a record high last year as advancements in drilling technology helped producers boost their output by drilling longer wells.

Its cash operating costs declined to $10.15 per barrel, compared with $10.52 per barrel, in the year-ago quarter.

The company forecasted 2025 capital expenditures between $6 billion and $6.4 billion and projected a 3% growth in oil production and a 6% rise in total production.

The company expects steady year-over-year activity levels in the Delaware Basin, with increased activity in the Utica and Dorado plays.

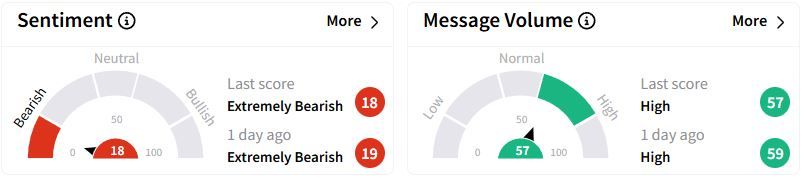

Retail sentiment on Stocktwits remained in ‘extremely bearish’ (18/100) territory while retail chatter was ‘high.’

Peers Devon Energy, Diamondback Energy and Occidental Petroleum had all beaten quarterly profit estimates earlier this month.

Over the past year, EOG stock has gained 15.6%.

Also See: SoundHound AI Stock Rallies After-Hours On Beat-And-Raise Q4: Retail Turns Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)