Advertisement|Remove ads.

Rocket Stock Takes Off After Big Q3 Earnings Beat — Retail Bulls See Housing Turning The Corner As Rates Ease

- On an adjusted basis, the mortgage firm reported earnings of $0.07 per share for the quarter ended Sept. 30, while analysts expected $0.05 per share.

- “Affordability is slowly improving as rates ease. In the third quarter, the 30-year fixed rate dropped by 40 basis points to 6.3%, giving those buying and refinancing some much-needed rate relief.” — CEO Varun Krishna.

- It projected adjusted revenue of $2.1 billion to $2.3 billion for the fourth quarter, which is typically weak due to the holiday season.

Rocket Companies Inc.’s (RKT) stock surged over 7.9% in extended trading on Thursday after the firm’s third-quarter earnings topped Wall Street’s estimates.

On an adjusted basis, the mortgage firm reported earnings of $0.07 per share for the quarter ended Sept. 30, while analysts expected $0.05 per share, according to Fiscal.ai data. Its adjusted revenue of $1.78 billion also topped estimates of $1.65 billion.

Mortgage Demand Showing Signs Of Improvement

The company said Rocket Mortgage generated $35.8 billion in net rate lock volume, a 20% increase from a year earlier. A rate lock denotes a fixed mortgage rate agreed upon between the lender and borrower. The company's sold loan volume in the direct-to-consumer segment rose to $17.14 billion during the quarter, up from $14 billion a year earlier.

“Affordability is slowly improving as rates ease. In the third quarter, the 30-year fixed rate dropped by 40 basis points to 6.3%, giving those buying and refinancing some much-needed rate relief,” said CEO Varun Krishna in a call with analysts, before adding that the rate of increase in home prices has also slowed.

The U.S. Federal Reserve has lowered its benchmark interest rate by 50 basis points for two consecutive months. Mortgage rates typically decline following such moves. However, Fed Chair Jerome Powell warned this week that another rate cut in December is not guaranteed.

Krishna flagged that existing home sales continue to hover around 4 million units, putting 2025 on track to be the slowest year for existing home sales since 1995. “Buyers are watching the market closely, they're waiting for clear signals and increased affordability before making their move,” he added. The company projected adjusted revenue of $2.1 billion to $2.3 billion for the fourth quarter, which is typically weak due to the holiday season.

Redfin, Mr. Cooper Deals Paying Dividends

In the analyst call, Rocket executives also highlighted meaningful gains from the recently closed multi-billion-dollar acquisitions of Redfin and Mr. Cooper. Redfin is a real estate brokerage company with an online platform and mobile app for buying, selling, and renting homes, while Mr. Cooper was a direct competitor of Rocket prior to the deal.

“About 13% of our purchase pipeline today is generated from Redfin clients, clients that were searching for homes on Redfin and looking to connect with the real estate agent, and then connect to mortgage,” said CFO Brian Brown.

The company said that it is already seeing the benefits of its $14.2 billion Mr. Cooper deal. “By day 9, 40,000 leads were flowing through our pipeline from the Mr. Cooper servicing book, and that number only continues to increase,” Krishna said.

What Is Retail Thinking?

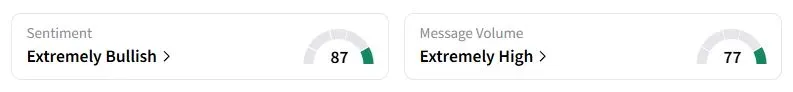

Retail sentiment on Stocktwits about Rocket jumped to ‘extremely bullish’ territory from ‘bullish’ a day ago, while retail chatter rose to ‘extremely high’ from ‘high’.

One user saw many analyst upgrades following the earnings report.

“This was an outstanding performance on earnings. Honestly, this is a great signal for buy. With rates lowering, this stock is seriously underpriced,” another user said.

Rocket stock has gained nearly 49% and also benefited from the so-called “meme-stock” frenzy earlier this year. According to Koyfin data, the stock's short interest has fallen from 48.5% in late July to 4.6% currently.

Also See: MSTR Stock Jumps After-Hours On Strong Q3 Profit, Still Sees Bitcoin Hitting $150,000 By Year-End

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)