Advertisement|Remove ads.

Root Stock Skyrockets 150% To Become Top Gainer On Q3 Profit And Revenue Surge: Retail Sentiment Soars

Shares of Root Inc. ($ROOT) surged over 150% Thursday morning, ranking as the top gainer across U.S. markets and the top trending ticker on Stocktwits.

The rally followed the company’s report late Wednesday, which highlighted a profitable third quarter and a major revenue increase.

The parent of Root Insurance reported a Q3 profit of $22.8 million, or $1.35 per share, significantly beating the FactSet consensus of a $0.93 per-share loss.

Revenue more than doubled to $305.7 million, far exceeding the analyst estimate of $272.8 million.

Co-founder and CEO Alex Timm expressed excitement over the results, saying, “While this quarter certainly validated our conviction, we are just getting started. With a strong capital position and ability to drive profit, we are excited to increasingly focus on profitable growth.”

Root said it intends to reinvest its profits to drive long-term value, which Timm noted would increase near-term operating expenses but strengthen the company’s technological advantage.

Additionally, Root announced a refinancing agreement with BlackRock. The amended facility consists of a six-year term loan with a principal amount of $200 million, reducing the previous facility by $100 million.

Root maintains $150 million in available capital under the amended terms, supporting its growth and enhancing financial flexibility.

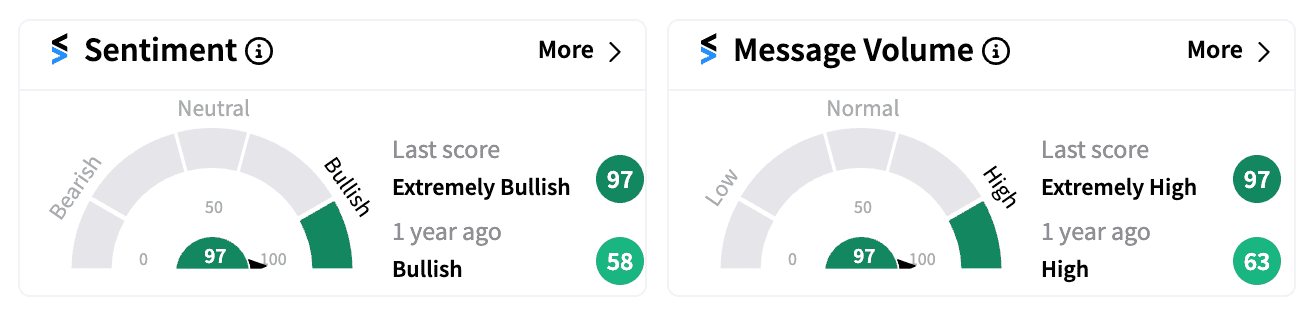

Retail sentiment on Stocktwits reached an ‘extremely bullish’ (97/100) level, the highest score in a year, alongside a surge in message volume as investors celebrated the earnings beat and positive outlook.

Root’s stock has now skyrocketed over 800% year-to-date, far outpacing the S&P 500 and Nasdaq indices.

For updates and corrections, email newsroom@stocktwits.com

Read next: Peloton Stock Surges As Q1 Earnings Beat, CEO Appointment Spark Retail Excitement

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237643016_jpg_17a9a7eb9d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221557373_jpg_2cb3ed82cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2251311021_jpg_31a407e714.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aluminum_resized_jpg_6efa759339.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)