Advertisement|Remove ads.

Ross Gerber Warns Of Intense Hardware Battle As AI Spending Sparks Competition Among Tech Leaders

- Gerber emphasized that the next three years will see fierce battles in hardware.

- Looking five years ahead, Gerber predicts that companies that scale most effectively will create competitive moats that are nearly impossible for rivals to penetrate.

- Google parent Alphabet had flagged spending between $175 billion and $185 billion in 2026.

Ross Gerber, CEO and co-founder of Gerber Kawasaki, on Thursday highlighted the intensifying competition in artificial intelligence infrastructure as major tech firms ramp up their spending.

In a post on the X platform, Gerber said that with more than $600 billion being directed toward AI infrastructure, the race to scale capabilities has intensified.

Next Three Years To See Battles In Hardware: Gerber

Gerber emphasized that the next three years will see fierce battles in hardware, as companies strive to establish dominant positions in AI technology.

The comment comes as companies like Alphabet (GOOG, GOOGL), Microsoft (MSFT), Meta Platforms (META), and Amazon.com (AMZN) are investing heavily to secure advantages in computing power and AI capabilities.

Shares of Google parent Alphabet fell 3% on Thursday morning after the company announced higher capital expenditures for 2026. The search engine giant said it expects to spend between $175 billion and $185 billion in 2026, a figure far above its previous $119.5 billion estimate.

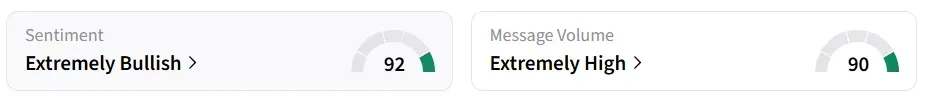

However, on Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day, and message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

Long-Term Strategic Moats

Looking five years ahead, Gerber predicts that companies that scale most effectively will create competitive moats that are nearly impossible for rivals to penetrate. This suggests that current investments in AI infrastructure are not just about immediate gains but also about cementing long-term dominance in the artificial intelligence market.

Meta has guided to an expenditure range of $115 billion to $135 billion for this year. Amazon is expected to lay out its plans in its earnings report on Thursday after the closing bell.

With large spending plans, major tech players are securing computing power, electricity, chips, and long-term infrastructure commitments to position themselves at the forefront of the AI arms race.

Also See: TEAD Stock Surged 25% Pre-Market Today — What’s The Connection With Google?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)