Advertisement|Remove ads.

Royal Caribbean Q2 Preview: Retail Bears Hold Course, Stock Dips After Scaling Record Highs

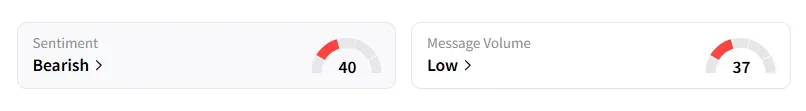

Royal Caribbean (RCL) shares fell nearly 1% during midday trading on Monday, and retail sentiment on the stock remained in the ‘bearish’ territory on Stocktwits ahead of the cruise operator’s quarterly results on Tuesday.

Notably, the marginal dip comes after the stock hit fresh record highs in recent times.

The company is expected to post second-quarter (Q2) net revenue of $4.53 billion, representing a 12.1% year-over-year increase, and earnings per share (EPS) of $4.08, according to data compiled by Fiscal AI.

Retail message volume on Royal Caribbean, the first of the three major cruise operators to report, was at ‘low’ levels, according to data from Stocktwits.

Shares of the company have risen 52% so far this year and jumped more than 125% in the last 12 months, driven by steady cruise demand and higher ticket prices.

A bullish user on Stocktwits said that Royal Caribbean is a ‘tremendous winner’ and it could be a profitable year.

Last week, Bank of America lifted its price target on Royal Caribbean to $355 from $230 and maintained a ‘Neutral’ rating, according to TheFly. Cruise line stocks have "meaningfully" outperformed the market and other travel stocks, returning an average of 72% since the market trough on April 8, according to Bank of America.

The brokerage expects positive commentary from cruise lines this earnings season as demand for sea-based vacations continues to grow.

Royal Caribbean raised its annual profit forecast in April, citing strong booking trends and easing fuel costs.

Morgan Stanley noted last week that it had raised forecasts and price targets for cruise stocks, partly due to better fuel and foreign exchange assumptions.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Nike Heads Toward 5-Month Highs After JPMorgan Upgrade: Retail Expects Stock To Hit $90-Mark

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)