Advertisement|Remove ads.

RVNL Trading In A ‘No-action’ Zone; SEBI RA Sudhansu Panda Eyes Support At ₹300 As Key Re-Entry Point

Rail Vikas Nigam (RVNL) has secured multiple projects this year, with the latest being a deal to design and construct a 7.3 km-long viaduct for the Delhi Metro Rail Corporation. However, while the fundamentals remain strong, the stock has been on a steady decline.

After reaching a high of around ₹440 last month, RVNL shares have slipped nearly 20% to hit a low of ₹353. At the time of writing, the stock was trading marginally lower at ₹358.90.

Currently, RVNL is trading in a no-action zone, reflecting a typical sideways market condition that often traps retail traders unaware of such price behavior, said Sudhansu Sekhar Panda, a SEBI-registered analyst at Bluemoon Research.

Historically, the stock has shown consistent support in the ₹300 - ₹320 zone, bouncing off this base multiple times before rallying to higher levels. This support range has now become critical, the analyst noted. If sustained, it may signal a reversal or base-building process once again.

The ₹440 mark has become a double-top resistance zone, making it a key level to watch in the next rally. Until then, the stock is expected to remain within a broad range, he added.

For long-term investors, Panda recommends accumulating the stock on dips, particularly near the ₹300 - ₹320 support zone. If RVNL retests lower levels, it may offer a strong buying opportunity with potential upside targets of ₹450 to ₹500 over time.

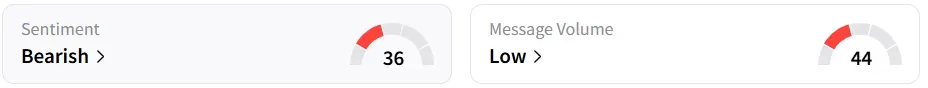

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a week ago. The participation ratio, which measures the ratio of unique accounts posting to the total number of messages in a stream, on the platform, was ‘extremely high’.

Year-to-date, the stock has shed 15.1%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)