Advertisement|Remove ads.

Salesforce To Acquire Informatica In $8B Deal, Transaction To Be Funded Via Combination of Cash, Fresh Debt

Software giant Salesforce Inc. (CRM) announced it will acquire data management company Informatica Inc. (INFA) in an all-cash transaction valued at roughly $8 billion, adjusting for Salesforce’s current equity stake in Informatica.

Under the terms, shareholders of Informatica’s Class A and B-1 stock will receive $25 per share in cash.

The acquisition aims to fortify Salesforce’s AI strategy by embedding Informatica’s sophisticated data management tools directly into its platform.

By integrating Informatica’s cloud-native capabilities, including its metadata architecture, governance tools, and Master Data Management (MDM), Salesforce intends to create a secure, transparent, and scalable data environment.

This ecosystem will allow autonomous AI agents within Salesforce to act intelligently and responsibly across complex enterprise systems.

Informatica will bolster Data Cloud's role as a Customer Data Platform by delivering unified, clean, and actionable data.

Platforms such as Agentforce, MuleSoft, and Tableau are also set to gain from improved data accuracy, analytics, and smooth system connectivity.

The acquisition is anticipated to be finalized in the early part of Salesforce’s fiscal year 2027, subject to regulatory approvals.

Salesforce intends to fund the purchase through a combination of its cash reserves and newly acquired debt. The company held $14 billion in cash and equivalents as of January 2025-end.

Salesforce expects the acquisition to start delivering gains to its non-GAAP operating margins, earnings per share, and free cash flow beginning in the second year post-closing.

Executives also stressed that the transaction will not interfere with the company’s current capital return strategy.

Salesforce will release its first quarter fiscal 2026 results on Wednesday, May 28, 2025, after market close.

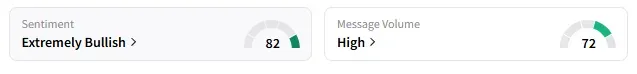

On Stocktwits, retail sentiment toward Salesforce changed to ‘extremely bullish’ from ‘bullish’ the previous day.

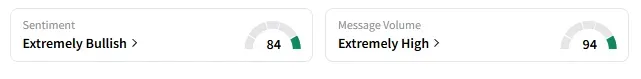

While sentiment around Informatica stock remained in ‘extremely bullish’ territory.

Salesforce stock has lost 18.3% year-to-date and has gained 1.2% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)