Advertisement|Remove ads.

Salesforce, ServiceNow Rejoin Dan Ives’ AI Watchlist After Software Sell-Off

Dan Ives, managing director at Wedbush Securities, has added Salesforce Inc. (CRM) and ServiceNow Inc. (NOW) to his influential AI-focused stock watchlist, signaling renewed confidence in major software names that recently faced heavy selling.

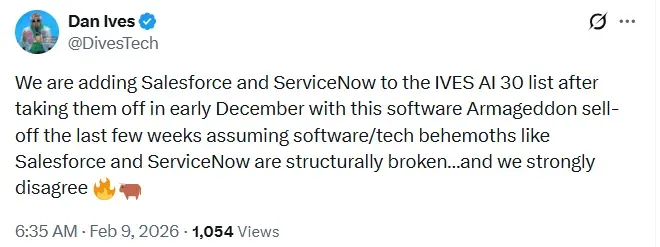

In a post on X, Ives noted that he is restoring Salesforce and ServiceNow to his IVES AI 30 roster after having previously removed them in December.

Was Software Selloff Overdone?

Ives described the recent sell-off in software as an overreaction that unfairly punished heavyweight software stocks, debunking the notion that the businesses were fundamentally flawed.

According to Ives, the recent flurry of AI tools released by companies like Anthropic, aimed at automating high-value work, has sparked fears that software budgets may shrink as AI takes over tasks traditionally handled by enterprise applications.

Additionally, solutions like OpenClaw, which operate across operating systems and applications to automate tasks, have raised questions about the future role of software providers. Despite these concerns, Ives believes the sell-off in tech stalwarts is overdone.

The AI List And Tech Rally Prediction

In December, Ives released an updated AI 30 list, removing SoundHound Inc. (SOUN), ServiceNow, and Salesforce, and adding CoreWeave Inc. (CRWV), Iren (IREN), and Shopify Inc. (SHOP).

He had also anticipated another year of gains in 2026, projecting that major technology names could climb roughly 20% in 2026 as AI expands into broader commercial uses.

Morgan Stanley Sees Opportunities In Tech Stocks

According to a Bloomberg report, Morgan Stanley strategists say U.S. technology stocks have room to climb further as optimism around artificial intelligence strengthens revenue prospects.

The research team, led by Michael Wilson, notes that revenue growth projections for top technology companies have reached “multi-decade highs,” while valuations have eased following recent volatility. At the same time, the downturn in software equities has created “attractive entry points” for investors, cited the report.

Also See: Why Did RITR Stock Surge 36% Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)