Advertisement|Remove ads.

Samsara’s Q4 Revenue Growth Slowdown, Weak Q1 Guidance Send Stock Sharply Lower After-Hours: Retail Mood Turns Buoyant

Samsara, Inc. (IOT), a connected operations platform provider, posted a fourth-quarter beat on Thursday, although revenue growth slowed sharply. The current quarter guidance came in below expectations, sending the stock lower in the after-hours session.

The San Francisco, California-based company reported adjusted earnings per share (EPS) of $0.11 for the fourth quarter of the fiscal year 2025, up from the year-ago quarter’s $0.04 and bettering the Finchat-compiled consensus estimate of $0.07.

Revenue jumped 25% year over year (YoY) to $346.3 million versus the $335.33-million consensus estimate.

Both metrics exceeded the high-end of the guidance issued in early December but the topline growth decelerated notably from the previous quarter’s 36% growth.

Annual recurring revenue (ARR), a key operational metric, jumped 33% to $1.46 billion. The growth marked a slight slowdown from the third quarter’s 35%.

The non-GAAP gross and operating margins expanded YoY to 77% and 16%, respectively, from 75% and 5%.

CEO Sanjit Biswas said, “Fiscal year 2025 was another year of durable and efficient growth.”

He noted that the company grew its $100,000+ ARR customer count 36% YoY to 2,506.

Samara expects first quarter adjusted EPS of $0.05 to $0.06 and revenue of $350 million to $352 million. Analysts, on average, estimate $0.05 and $351.31 million, respectively.

The company initiated its fiscal year 2026 guidance of $0.32 to $0.34 in adjusted EPS, above the estimated $0.28, and $1.523 billion to $1.533 billion in revenue, aligning with the consensus of $1.528 billion

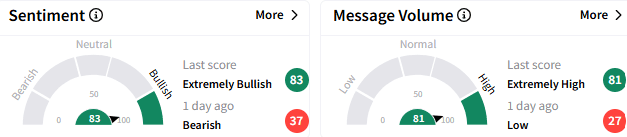

On Stocktwits, retail sentiment toward Samsara stock reversed to ‘extremely bullish’ (83/100) from the ‘bearish’ mood that prevailed a day ago. The message volume surged to ‘extremely high’ levels as trader chatter grew amid the earnings release.

A bullish watcher said the stock has a strong support at the $40 level despite dropping below the mark in the after-hours session.

Samsara stock ended the after-hours session down 5.56% at $39.55. The stock is down over 4% year-to-date.

For updates and corrections email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tim_cook_OG_jpg_08b852f801.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_etoro_logo_resized_jpg_e33db568c2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamieson_greer_jpg_e66ba6dd7a.webp)