Advertisement|Remove ads.

Sanofi To Buy Blueprint Medicines For Up To $9.5B: Retail Sees More Acquisition Offers From European Pharma Companies

Shares of Blueprint Medicines Corporation (BPMC) traded 26% higher in pre-market on Monday after French pharmaceutical company Sanofi (SNY) announced that it would acquire Blueprint in a bid to expand its rare immunological disease portfolio.

Under the terms of the deal, Sanofi will pay $129 per share in cash at closing, representing an equity value of approximately $9.1 billion.

The upfront purchase price represents a 27% premium to Blueprint’s closing price on Friday of $101.35.

In addition, Blueprint shareholders will receive one non-tradable contingent value right (CVR), which will entitle them to receive two potential milestone payments of $2 and $4 per CVR for the achievement of future milestones for BLU-808, an investigational therapy with the potential to treat a broad range of diseases in immunology.

The total equity value of the transaction, including potential CVR payments, represents approximately $9.5 billion on a fully diluted basis, Sanofi said. The firm added that it expects the transaction to be completed in the third quarter of 2025.

The acquisition includes Ayvakit or Ayvakyt (Avapritinib), the only approved medicine for rare immunology diseases, advanced and indolent systemic mastocytosis (ASM & ISM), in addition to Elenestinib, an investigational medicine for systemic mastocytosis, as well as BLU-808.

Sanofi CEO Paul Hudson said that the company retains a “sizeable capacity” for further acquisitions. The firm expects the Blueprint acquisition not to have a significant impact on its financial guidance for 2025 but to be immediately accretive to gross margin and to business operating income and EPS after 2026.

Last month, Sanofi said it is looking to invest at least $20 billion in the U.S. through 2030. The company also announced it would acquire U.S.-based Vigil Neuroscience, Inc. (VIGL) for about $470 million soon after.

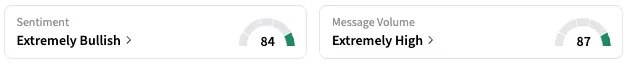

On Stocktwits, retail sentiment around Blueprint Medicines Corporation jumped from ‘bearish’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘normal’ to ‘extremely high’ levels.

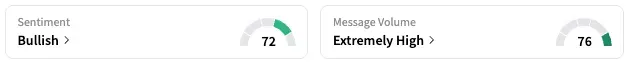

Meanwhile, retail sentiment around Sanofi stayed unmoved within the ‘bullish’ territory while message volume rose from ‘high’ to ‘extremely high’ levels.

A Stocktwits user believes U.S. pharmaceutical companies will receive acquisition offers from their European counterparts.

While BPMC stock is up by about 16% this year, SNY stock is up by over 2%.

Read Next: Microsoft Commits $400M To Boost Swiss AI, Cloud Ecosystem: Retail Mood Stays ‘Bearish’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Meta_jpg_0f17dacb20.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244842667_jpg_931c352b95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)