Advertisement|Remove ads.

Sapphire Foods Surges On Merger Reports: SEBI RA Sees Potential Upside Upto ₹430

Shares of Sapphire Foods rose nearly 9% intraday on Friday on reports of a potential merger with Devyani International.

At Friday’s close, Sapphire Foods stock pared some gains to end 4.2% higher at ₹334, while Devyani shares closed 3.5% higher.

Yum Brands, the parent company of KFC and Pizza Hut, is reportedly in discussions to facilitate a merger between its Indian franchisee partners, Devyani International and Sapphire Foods, according to a report by The Economic Times.

In an official press statement, Sapphire Foods stated that it has no material information to disclose at this time, noting that the company regularly evaluates various strategic opportunities as part of its normal business operations.

According to SEBI-registered analysts A&Y Market Research, consolidation in the quick-service restaurant (QSR) space could streamline operations and reduce competitive overlap, especially in metro markets. It could also lead to margin expansion and enforce leverage with suppliers, and the market sees this as a win-win opportunity for both companies.

Short-term setbacks could include potential regulatory approvals, integration challenges, including capital requirements, and risks of brand cannibalization in overlapping Tier-1 locations, the analyst said.

From a technical perspective, Sapphire Foods stock is facing key resistance at ₹345.80, with a bullish bias triggered only on a decisive breakout above ₹346 backed by strong volume, they said.

Once confirmed, short-term momentum could build, while mid-to-long-term targets lie at ₹374, ₹400, and ₹430. The analysts recommended a stop-loss below ₹325.

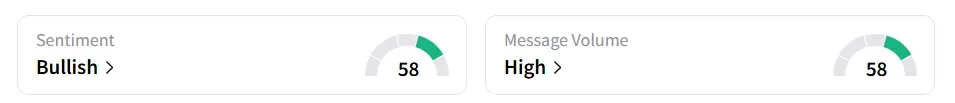

Retail sentiment on Stocktwits for Sapphire turned ‘bullish’ from ‘neutral’ a day earlier, amid high message volumes.

Year-to-date, Sapphire Foods stock has fallen 3.44%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)