Advertisement|Remove ads.

Sarepta Pauses Shipments Of DMD Drug Elevidys Amid FDA Label Review, Stock Tumbles After-Hours

Sarepta Therapeutics shares closed over 5.3% lower on Monday, hitting more than a nine-year low, and fell another 8.5% in after-hours trading after the biotech firm announced a voluntary halt to U.S. shipments of its Duchenne muscular dystrophy (DMD) gene therapy, Elevidys.

The pause follows a request from the FDA last Friday to temporarily stop shipments after a patient receiving a different experimental treatment died. Sarepta is also updating safety labeling following two earlier deaths from liver failure in patients with advanced-stage DMD.

Elevidys is fully approved for ambulatory children with DMD and conditionally approved for non-ambulatory patients. The shipment pause, effective Tuesday evening, is intended to give Sarepta time to address FDA information requests and finalize the updated safety label.

"The decision to voluntarily and temporarily pause shipments of Elevidys was a painful one, as individuals with Duchenne are losing muscle daily and in need of disease-modifying options," said CEO Doug Ingram.

In a separate regulatory filing, Sarepta said the FDA has also placed a clinical hold on its investigational limb-girdle muscular dystrophy (LGMD) gene therapy trials. The company said it intends to seek accelerated approval for SRP-9003 once the hold is lifted.

Wall Street Loses Confidence

Several analyst firms had already turned bearish on Sarepta ahead of the Elevidys pause, according to The Fly:

- UBS downgraded Sarepta to 'Neutral' from 'Buy' and slashed its price target to $12 from $45, citing FDA uncertainty and reputational damage.

- Piper Sandler cut its target to $18 from $32, warning of potential forced withdrawal but suggesting a risk-evaluation safety program may be a more likely outcome.

- Mizuho downgraded the stock to 'Neutral' from 'Outperform' with a $14 target, citing growing safety concerns tied to the company's AAVrh74 vector platform.

- H.C. Wainwright slashed its price target to $0, assigning a 'Sell' rating and saying Sarepta has no remaining intrinsic value without Elevidys' revenues.

Retail Holds Out Hope

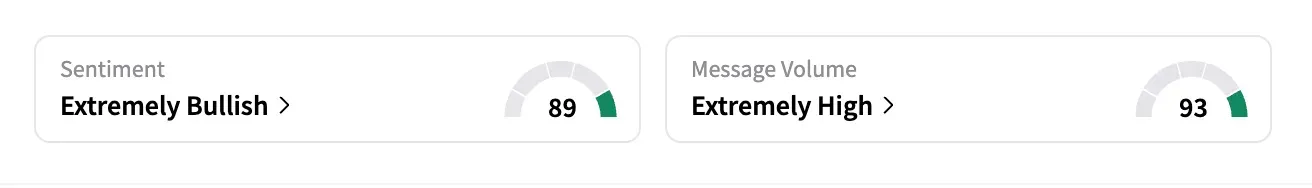

On Stocktwits, SRPT was among the top-trending tickers late Monday, with a 24-hour message volume increase of 334% and an 'extremely bullish’ sentiment.

"Headline should be: Miracle life-saving drug pulled for only saving 99.4% of patients," said one user.

"So three deaths [are] bigger than prolonging the life of 900 patients. And how do they know conclusively that Elevidys is what killed the three non-ambulatory patients that were already in very poor health and had questionable life span already," said another. "I have no position in SRPT (yet) but something is not adding up here."

Short interest in Sarepta has climbed sharply this year, rising from 5.9% in January to nearly 15% as of last week, according to Koyfin data. The stock now trades at a 147% discount to analysts' average price target. Out of 26 firms covering the stock, 11 rate it a 'Buy' or 'Strong Buy', two have a 'Sell' rating, and the rest recommend holding.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Merck Commits To Veeva’s Vault CRM, Draws Wall Street Cheer

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)