Advertisement|Remove ads.

SBI Gains 6% In A Month, SEBI RA Says Breakout Above ₹805 Could Fuel Further Upside

State Bank of India (SBI) shares are back in the spotlight with analysts turning bullish after a technical breakout pattern and rising volumes. A recent board-approved stake sale in Yes Bank has also added to investor optimism.

SBI shares surged 3% on Monday, extending their monthly gain to 6%, after the bank’s board approved divesting a 13.19% stake in Yes Bank to Japan’s Sumitomo Mitsui Banking Corporation (SMBC) for ₹8,888 crore at ₹21.5 per share.

SEBI-registered analyst Saurabh Sahu observed that SBI stock recently formed a strong bullish candle accompanied by increased trading volume, signaling renewed buyer interest in the ₹760 to ₹770 price range.

This uptick in volume follows a period of decline, which Sahu interpreted as a bullish indicator.

He suggested that a breakout above the ₹805 level, confirmed by a candle closing above this price accompanied by substantial volume, would likely validate the continuation of the bullish trend.

Sahu believes the stock has the potential to rise to the ₹830 to ₹850 range, while recommending a strict stop-loss at ₹775 to manage the downside risk.

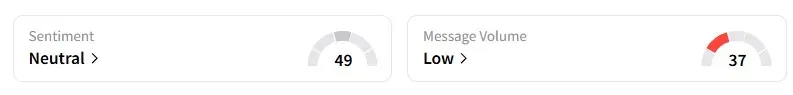

Data on Stocktwits shows that retail sentiment on the counter remains ‘neutral.’

SBI shares gained 1% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)