Advertisement|Remove ads.

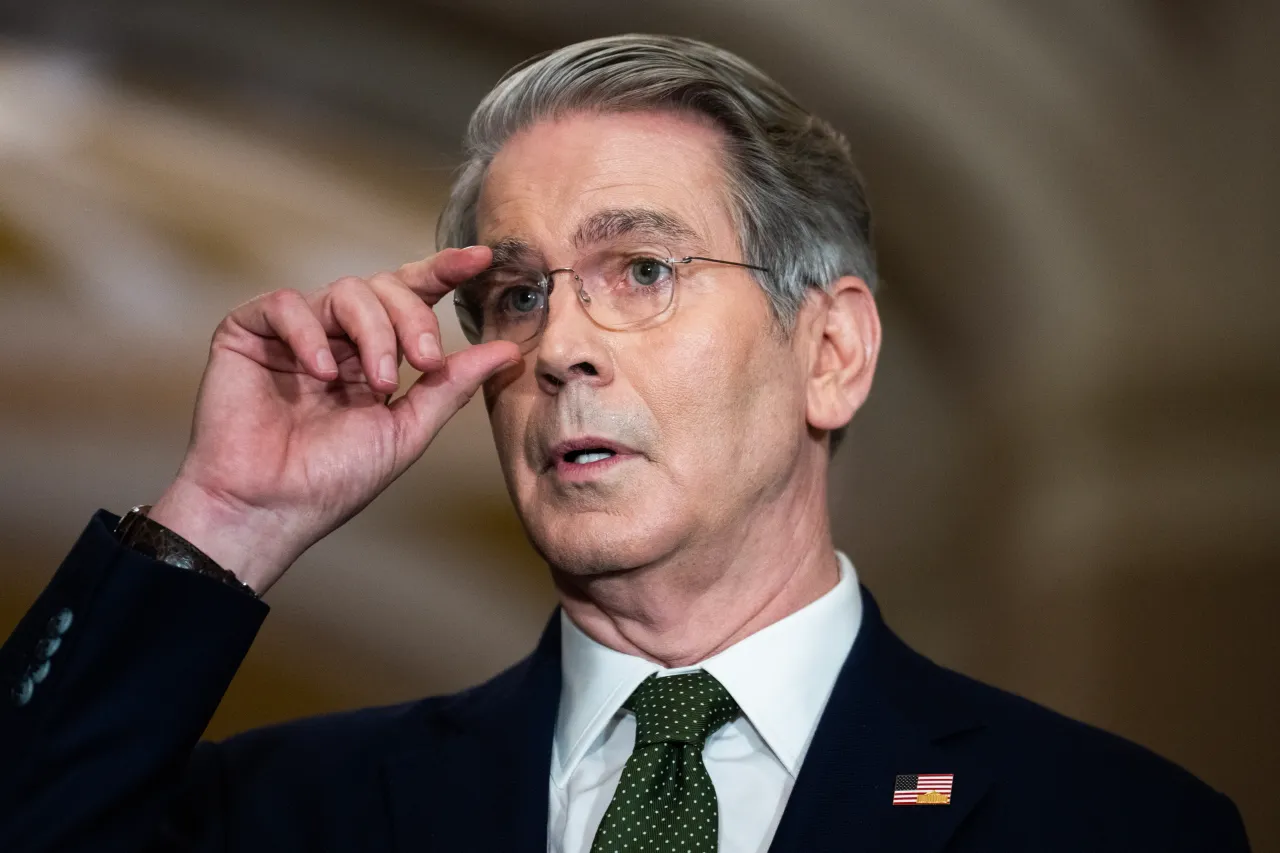

Scott Bessent Says US ‘Not Going To Rush’ Into Deal Ahead of August Tariff Deadline, Signals China Talks In ‘Near Future’

Treasury Secretary Scott Bessent said on Monday that the U.S. is “not going to rush” just to close deals ahead of the August 1 deadline for finalising a trade deal with the country, or face steep tariffs.

U.S. stocks appear poised for a positive opening on Monday as investors continued to watch for developments on tariffs from the Trump administration. The SPDR S&P 500 ETF Trust (SPY) was up 0.17% and the SPDR Dow Jones Industrial Average ETF (DIA) gained 0.22%. The Invesco QQQ Series 1 Trust (QQQ), which tracks the Nasdaq-100, gained 0.13% on Monday morning.

On Stocktwits, retail sentiment around SPY remained in the ‘neutral’ zone as compared to a day ago. Over the past month, however, it has moved higher from ‘extremely bearish’ territory.

In an interview with CNBC, Bessent clarified that whether or not the deadline for closing trade deals will be extended is entirely up to President Donald Trump.

“We’ll see what the president wants to do,” he said. “But again, if we somehow boomerang back to the August 1 tariff, I would think that a higher tariff level will put more pressure on those countries to come with better agreements.”

Bessent added that further negotiation with China is on the table, stating that there would be "talks in the very near future." However, he also highlighted broader strategic concerns.

“I think trade is in a good place, and I think now we can start talking about other things,” he said. “The Chinese unfortunately... are very large purchasers of sanctioned Iranian oil, sanctioned Russian oil.”

He also pointed to economic imbalances, calling for “this great rebalancing that the Chinese need to do.”

Bessent said he would support European allies aligning with the U.S. if Washington imposes secondary sanctions on Russia. Speaking about Japan, he emphasized that the administration is focused on securing the strongest possible agreement for American interests, regardless of Tokyo’s domestic political calendar.

Bessent also criticized the Federal Reserve, stating that there needs to be an examination of whether the central bank has been successful as an institution. "I think that what we need to do is examine the entire Federal Reserve institution and whether they have been successful," he said, adding that he is scheduled to give a keynote speech at the U.S. central bank on Monday evening at the start of a regulatory conference.

"If this were the (Federal Aviation Administration) and we were having this many mistakes, we would go back and look at why. Why has this happened?" he said. "All these PhDs over there, I don't know what they do."

Bessent declined to comment on a report stating that he had advised President Donald Trump not to fire the Federal Reserve Chair Jerome Powell, saying that the decision lies with Trump.

Read also: GE Vernova Reportedly Taps French AI Firm Alteia SAS To Modernize Grid Checks

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)